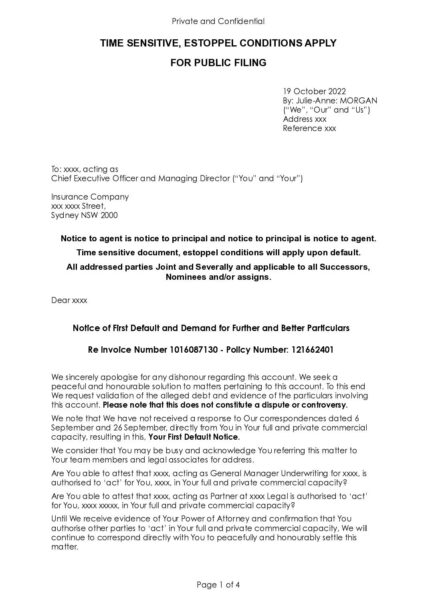

-

Help settling an insurance debt

As a newbie, for my first attempt I have taken on an outstanding insurance premium.

After my first Notice, they have confirmed via their general manager and lawyer that they “cannot locate the original contract at this time”.

In my second notice and demand for further and better particulars, and their first default (see attached), I asked:

– “Should the contract be considered as null and never existing, resulting in full refund of all premiums?

– If and when We agreed to a policy with xxxx or their predecessors, was it offered under full disclosure?

– If and when We agreed to a policy with xxxx or their predecessors, was a trust, security, bond or any other financial instrument created? Please answer Yes or No in writing.”Under estoppel conditions, I also added:

“Should You default a third and final time, it will be taken as Your tacit agreement that:

1. No lawful contract, based on full disclosure exists between Us and xxxx; and any alleged contract / agreement between Us and xxxx is null and void or at least revoked, and We demand within 7 days:

a. Any alleged outstanding amount balanced and returned to zero

b. A statement showing the discharge of the alleged debt showing zero balance

c. A written guarantee that no report of a negative nature or bad credit be given to any credit reporting agencies.

d. Full and complete refund of all credits paid upon xxxx policy 121662401 by Us, payable by cheque to the above address.

e. Cancellation of xxxx policy 1216624012. xxxx and/or their predecessors did not disclose their intentions and actions to convert an agreement / contract / promissory note by using it as “value” to give value to a bond /cheque or similar financial instrument, as proven by xxxx bookkeeping entries, thus proving the “policy holder” funded the policy and proving xxxx used concealment and false statements that xxxx funds the policy.

3. Admission of Your participation in fraud, piracy and barratry.

4. Additionally, We will seek remedy to any financial instrument created and a financial settlement, with details yet to be determined or agreed.This will then be entered in an affidavit of fact.”

I have just received a response where, they have not answered any of the questions (no surprise) but offered to waive the outstanding premium and confirm no negative credit rating.

I was considering a conditional acceptance upon the man acting as the Managing Director/CEO, providing an affidavit confirming that:

– the contract does exist and was offered under full disclosure

– it has not been used to create a financial instrument of any nature.

Are there any better suggestions on how to proceed?

Is there anyone with sufficient experience willing to facilitate a round table negotiation with me over zoom?