Homepage › Private Community Forums › Discharging Liabilities (Debt) › Tax liability

-

Tax liability

Posted by whitelight on January 11, 2023 at 8:10 pmHi, I have a tax liability for around 40k, I’ve watched Marks video on Bills of exchange and promissory notes. I even wrote my first bill of exchange to pay for a parking infringement with Parks and Wildlife, still waiting to hear back. I’m now thinking of paying off the 40k with a promissory note but have a few questions I’m hoping some one int the group can answer.

1. I’ve already paid off some of the 40k so have I entered into a contract by doing this or can I write a PN for the remaining amount?

2. What backlash could I expect from the ATO?

3. Is this likely to go to court?

4. Is there any reason why I shouldn’t do it?

5. Any vote of confidence in an anecdote would be greatly appreciated

I appreciate the support in this Community.

cherax replied 1 year, 11 months ago 4 Members · 45 Replies -

45 Replies

-

-

I have similar situation of alleged liability for crypto gain, FY21. Funds were then stolen (exchange collapse) FY22. Aus Theft Office will not offset gain to loss. Similarly I have set up payment system to buy time and looking to pay out with PN or BOE. I have the PN module but no practice to implement it yet. Unsure also of the ramifications of agreement to payment plan. Goodluck Whitelight.

-

Hello cherax. Where are you at with this? There may be a few approaches that could be taken. Certainly you could use a PN and learn to hold your position. Another approach is to go back to the beginning and correct the ‘errors’ that lead to the alleged liability. Did you ‘self declare’ an alleged income? Did your accountant press you in to it? Or was it the result of assertive ATO action? There may be grounds simply to submit a corrected tax return and deal with the issue that way.

-

Hi Chuggles .In short the loss was in following fin year and not submitted yet (accountant) still reluctantly making payments to buy time. A crypto tax co did the returns as i was trading as well. They (agent) have wiped off exchange losses now, but form yet to be submitted as i said.

-

Thanks for the update. Your path of least resistance is to following through with the ‘usual’ paperwork and claim losses. Once that is done possibly follow up with a ‘corrected tax return’ for previous years.

If you’re determined you want to take a different approach, PN for instance, then I’m happy to talk with you about how you might do that. I have spent a fair bit of time trying to understand PNs and have started using them.

By submitting a tax return you self declare a liability and having entered a payment plan you have further acknowledged and accepted the liability. This would need to be rebutted.

-

Cheers for that. What have you used PNs for so far? Have you had successes?

-

Initially I didn’t understand PNs so I used two other approaches with success. I helped someone with a ‘counter offer’ for a $5,500 Vic Police fine for a Covid breach. That person was deep in trouble and had agreed to a payment plan then not followed through. I devised a strategy and we cleared the obligation with a $25 counter offer. It still required holding ground.

I used a BOE for a toll matter in QLD. Again needed to hold ground but the matter went away with only 1 follow up letter.

Currently using PN for two traffic matters in Vic and am about to use one to settle a Court related obligation, again in Vic.

Now that I understand PNs much better it will be my ‘go-to’ approach for dealing with matters.

Every approach will require ‘holding ground’.

-

Nice work. Yep agree that a good understanding in the processes, and holding ground essential before putting into action.

-

-

Hi chuggles.

What do you mean by usual paperwork for claiming losses?

-

Hello Cherax. In that context that would be the usual taxation paperwork to clear up that matter. Basically deal with it the way the system wants to you in order to clear it, and then focus on submitting a corrected return.

-

Ok thanks. My personal returns have been bundled with my company tax and completed by an ato compliant accountant. FY22 returns are about to be sent to me for review before lodgment. I take it that they get submitted before I make amendment to Fy21 and clear up the error personally (without accountant).

-

That is an option and one that reduces friction with your current tax agent.

-

Hi Chuggles. What is the approach for this on tax amendment form ? State that you wrongly entered that you had a capital gain, or wrongly declared an asset you converted to another asset was a sale, and therefore a gain? I dont want to get into the weeds of detail. The issue seems to be I engaged a Crypto tax company that is also trying to stay compliant with the regulators and now they also have all my information. Trying to pick the right wording to not raise a red flag their end.

-

Hello Cherax. Without wanting to contradict myself from earlier I’ll say: it will likely always be easier with the ATO to send only accurate information, rather than need to go back and submit a correction.

However… there could be other friction points, like your accountant or a crypto company reporting directly to the ATO etc.

Just because a third party (crypto company) makes a report to ATO doesn’t mean it is true, doesn’t mean it was income and doesn’t mean it was for you. It could be held on trust by the name for another entity, or for the living man.

I’m helping someone else atm with an ATO matter where out of the blue they get a tax bill for over $5k. Even though his (now dismissed) accountant says there is no basis for the claim. However as he didn’t get the first notice now, officially, the only option is to pay the sum and claim it back on a future return. This is clearly not satisfactory.

We have already written to the ATO taking the; we don’t understand; please provide the documents you are relying on approach. We will staunchly hold our ground and if really pressed we will; offer to pay provided they commit to not denying us a lawful remedy. We will then satisfy the obligation to pay with a PN and hold our ground on that. (Remember Taxation Administration Regulation 21 specifically says that a tax liability must be paid in Australian Currency and the Banking Act 1959 Sect 39 defines Australian Currency as, amongst other things, including Promissory Notes.

I have submitted a corrected return for last year due to errors from the accountant. I’m still waiting for confirmation from the ATO that it has been accepted. If they raise any questions I plan to hold my ground by, amongst other things, requiring the documents they are relying on and wanting to know which official (personally) has rejected my lawful claim.

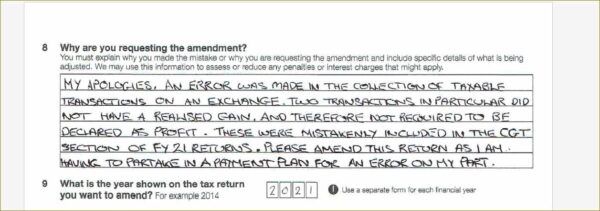

Regarding your question of what to write on the tax amendment form I’ll say firstly that an asset swapped for one of equal value can not result in income (obviously). It is simply an exchange. That is something worth holding ground on. In my case, which is different to yours, I wasn’t really sure what to write so I made a general statement about certain funds attributed to the wrong name and being classified as income when it wasn’t income (or something like that). I’ll see what they come back with.

All that to say there are several ways you could go however you need to make sure you personally understand the approach and are committed to it.

I’m happy to make suggestions regarding a specific approach you choose.

All the best.

-

if you are going to discharge the liability with an instrument, just remember to ask for a Statement of Account. if they refuse to give you one then you have evidence you wanted to settle the liability and they would not allow you to by withholding a Statement of Account.

-

Thanks for the response, totally agree on the value for value exchange of asset, and the absurd deeming it a sale and imaginary return to fiat for their gain. Its most likely the angle I should take first. but that may get into an interpretation loop and i would have to win that argument first. May be less resistance with the wrongly declared income statement and hope it just gets amended without questioning the details. If I get resistance then play the prove its not a simple value for value exchange and not actually income, and then hold ground.

-

Hi All

I have returned an amended tax return adjusting down the taxable amount, with note that original figure included non taxable amounts. Requested also a statement of account, which was sent as I refused to use MYGOV. (also requested all future correspondence and notifications to be mailed.

Followed up with a notice/explanation of why the amount was non taxable. (swap value for value no profit realized.) No response as yet, Are the documents of conditional acceptance in minimizing tax pack as well as information on rebuttals?

-

Module 2 contains examples of completed tax returns, a declaration that accompanies the tax return, a Notice from the ATO, a Notice in reply to the ATO with supporting affidavit and lots more, it also has an example of a conditional acceptance.

-

Hi Morag. I have the module 2 now but not sure whether i need to wait until ATO responds to my amended form (excluded my unrealized gain) so I have something to work with (which was 30 days ago) ? Also should I have purchased module 19 that you mentioned to Brian ,that includes the 3 step process , then questioning their authority to deem an asset to asset swap, a return to fiat and taxable?

I am churning through all material I can find to sort which method to use

-

I recommended that module 19 to him because of the way he had completed his Notice. I could see he needed a template to work with to put him on the right track as to how to lay the Notice out competently. If you feel you need help in that area then it might be something that would be helpful, however if you are confident in your layout and you have worked from other examples you have seen on here then you should be ok without it.

-

Module 19 doesn’t deal with tax but has a good example of the 3 step process of Demand for better and Further Particulars and shows how the Notices need to be laid out.

-

In answer as to whether to use the Module 2 now or not, that depends on where you are (how far along and what the next step is) in the process and which process you are doing.

-

Thanks for the explanation.

All I have done to date is filled out an amended tax form, reducing the taxable amount to eliminate the $ amount that was asset flipped including an explanation on the form ( I should have removed all the crypto gains as income) this was on the 20-4-23. I have also requested and received a statement of account, as I had earlier agreed to a payment plan, but the 72 hours has lapsed as I was expecting the amended form to be responded to, before I decided whether to convert SOA to an invoice. That is why I was looking for the 3 step process. I will need that eventually anyway. Its been a month now & I’m uncertain whether to start a process or wait for form to be responded to. What are you thoughts?

-

I would ring them and ask what is happening, record the conversation (and let them know I was recording for training purposes) so I could add it to an affidavit. If I had evidence they had received my correspondence (eg evidence by way of registered post) then I would ask if they had acted on my instructions or if they were going to carry them out and if yes when will they action this. Once I had received their answers I would make a decision as to my next move. eg if they claim they hadn’t received it then that would not be valid as I would have proof they did so I would start a three step process. If they say they are going to carry it out then I would ask for a date. I would wait for that date to come and go and then I would start a three step process. I would be careful only to answer questions if they were necessary and I would be careful not to incriminate my self. eg I would say ‘I answer to the name blah blah out of necessity for the purposes of these types of conversations’ Remember these are just suggestions based on what I have been learning on this site. I have had very little personal experience dealing with the Tax Department. A great Module to purchase for having face to face dealings with the Tax department is Module 35 Settle Any Outstanding Matter With the Adversary at a Round Table Meeting.

-

Thanks for your help Morag.

They actually just tried to ring me just before I read this, and I let it go, so as to respond to them by mail, (that I had received a sms from them to converse by phone) but my preference is to request all correspondence by mail. The fact that they have attempted contact possibly means they are reviewing the amendment i sent, or to tell me I have missed a few plan payments.

-

Ok fair enough, correspondence by mail is always better because it gives you time to think of an appropriate response without so much pressure. Let us know how everything unfolds.

-

I have received an account in arrears notice now, but I think I may have missed the rebuttal stage. Although I have made an apology for an error. My process so far has been to seek some engagement to collect data for my arsenal but the department just marches on unabated. I have not received any purposeful response to any individual request.

Details

Made an alleged gain in assets (swapped not sold)

Accounting firm submitted return including the alleged gain

Statement sent to me with alleged obligation to pay

Payment plan entered to buy time.

Payment plan commenced

Payments ceased

Notice sent (by self)request for clarification (no profit-swap not sale)

Amended tax form sent (by self)

incoming phone call attempted

Notice sent to request mail correspondence (by self)

Arrears statement received

Should I rebut the acceptance of the original liability to move forward?

Any thoughts ?

-

I don’t know what you should do, but you have some choices such as discharging the liability with a PN or BOE however this process requires you to know how to take it all the way to the Supreme Court if necessary and how to handle all of the fishhooks in court. It’s sometimes just a matter of trial and error and working out what you feel comfortable doing and then observing the results and taking the next step that you think will be the best next one to take from everything you are learning on here.

-

Have spoken with ATO now and have a verbal acknowledgment that they are escalating my amendment of 2021 form. However they still maintain that I owe them 2 instalments of PAYG even though I have no wages (different matter). I do not want to pay this but I am not wanting to be dishonorable in their eyes either. I now am contemplating conditional acceptance based on their decision to put me onto a quarterly PAYG plan without my consent. we will see what comes back, while waiting for the amendment reply. They have given me the option to clear all 19k debt in one payment, maybe a P/N with the statement of account that they have sent me, is my best option for that but still studying that module, It would have been nice to have got some practice on smaller matters before tackling that one with all the fish hooks as you say. 🙂

-

Just remember if they are making claims, the burden of proof is on them so always ask them for proof of any claim and don’t make any statements/claims yourself without airtight evidence of this (that can be used in court if necessary).

-

Thanks Morag

Im still unsure whether to fight this payg amount of $1400 based on the fact that I will get It all back anyway, I just dont want to give It to them in case they hold it against the larger amount they are trying to plunder from me haha

Is the conditional acceptance used the Estoppel? as I have also seen the notice of demand form

-

-

Sorry I thought I deleted that line and image before posting.

-

What do you mean by “Is the conditional acceptance used the estoppel” ?

-

Hi All

I have an approach for my PAYG matter. I am sending a conditional acceptance. Anything missing?

Is a declaration to go with this?

Thanks.

-

It’s all in order the only addition you need to make is to have an affidavit (signature witnessed and affirmation taken by a JP) to evidence that you are living and to establish the facts of the matter with evidence to support the facts as exhibits.

-

Does anybody have any examples of the “notice of payment document” for the ATO in particular, when paying by P/N? I’m not clear on what wording needs to be included in the document body, as the examples in p/n pack describe banking loan terminology not a tax liability. I am also looking for a position for my TFN within the document. thought id throw it out there while I continue scanning the Q&As and posts.

Thanks.

-

There are examples of Notice of Payment in Module 10 strategies to Discharge Credit Card Debt

-

-

-

-

-

-

Well then, our situations are very similar. I read through the PDF provided above and the case discussed in that, was for the payment of an outstanding amount for a business loan using a PN. I would love to know the outcome. What I took out of it, is that the business loan was already in use and the contract entered into and it was still getting paid out using a PN, so it should work for my/your case.

-

That was my interpretation also, It would be great if the questions you raised in your 1st post were clarified also, that would maybe make things clearer. But will continue to work through the process anyway.

-

-

Hello whitelight. Is this matter still open? I’m happy to engage with it as I think you have a good case to hold your position. Let me know where things are at. Thanks