Homepage › Private Community Forums › Company / Business Owners › ATO fines for late submission of a business activity statement dispute

-

ATO fines for late submission of a business activity statement dispute

Posted by brianchu82 on March 29, 2023 at 6:43 pmHi there,

Last year, I was not aware that I had to file a Business Activity Statement every quarter as I have a GST-paying corporate entity. However, I had been estimating the amount that I was required to pay taxes and GST during the period and made a payment accordingly.

So I received the penalty notices late last year requiring me to pay fines for not filing a Business Activity Statement. I immediately contacted my accountant to file the statements for me to catch up. I also called the ATO and the consultant was kind enough to explain to me about the PAYG taxation system that now applies to businesses. She also recognised that the tax liability I owed was too onerous for my business currently and arranged a payment plan to stretch out the payments. She also said that while I would be liable for the fine for late lodgment of my BAS, as long as I make a payment and then file the BAS subsequently, I could appeal to have my fines remitted. Upon ending the call, I thanked her and told her to contact her supervisor so I could give my positive feedback to her.

I received last week a penalty notice following up on the fine that the consultant informed me. I then called up the ATO and another consultant answered the call and said that I could not get it remitted because not knowing that I had to file a BAS is not grounds for remitting my fine. So now I have to contest the fines.

Anyone have experience writing to the ATO to deal with such issues? I also have incurred a significant tax liability because these days the ATO assumes last year’s tax payable and adds that onto the amount we have to pay in advance for the next financial year, adjusting it only after the financial year has ended and our next tax payable is calculated. Given that the economy has put most businesses under a lot of strain, how can I motion to have the ATO remit my fine and potentially even discharge my company of these liabilities? I am happy with the option of entering into yet another payment plan to stretch out the payments of the liabilities.

Thank you in advance.

God bless,

Brian

morag-janet-of-the-hill-family replied 1 year, 10 months ago 5 Members · 27 Replies -

27 Replies

-

Are you a sole trader or partnership? Mark has a good module on dealing with tax. I have some issues with a tax liability from a defunct partnership and I can’t close it because I won’t use MyGov. I discharged the balance last year with a non returned A4V money order, but they haven’t zeroed the account. They claim not to have received returns, but they refused to collect a registered letter with returns. My last letter rebutted their fines and they haven’t replied for weeks. I asked for evidence that they are a court with the authority to impose fines and penalties, according to the High Court ruling. There’s been no answer. It’s an ongoing game, but I’m not giving up.

-

Hi there Imangan,

It’s a corporate entity. I am a trustee with my wife of this company that is the trustee company of a registered trust which holds our gold mining stock portfolio.

We started this trust because it is part of my brand as an editor of a gold stock newsletter writer. I wanted to have a separate vehicle of gold stocks that I can show its performance track record to demonstrate my skills in delivering outperforming returns relative to an ordinary investor.

God bless,

Brian

-

Thanks for the reply. That’s a very impressive initiative. I can only speak from experience with individuals or partnerships. You have a situation where your corporation is dealing with another privately owned corporation, the ATO. Perhaps seek advice in a message to one of the admins. We politely cut ties with our accountants as we were not paying any more to the corporate pirates or their nominated agents. Good luck with it. I’m curious to know the outcome.

-

Thanks Lyn.

I think during such challenging times as these where many businesses and ventures are struggling, it’s important to try and bend and twist the ATO’s arm if we can. The fines they are imposing of $222 for each late submission of the BAS may not be a big fine in the scheme of things. However, I am reluctant to pay it for an unintended error, and frankly a rookie one where my accountant did not flag it with me. That and I had not realised that I needed to file a quarterly BAS because they moved me into a PAYG scheme without directly informing me.

I might need someone with corporate experience to help direct me in whether I need to keep receipts of transactions for tax purposes or are credit card statements showing the transactions good enough.

And also I am curious as to how to frame the dividends that I pay out of the corporate entity to my wife and I as our sustenance payments so the ATO cannot compel us to pay any taxes on those.

In addition, if the corporate entity pays my wife and I in contributing to the venue and bills for the work component, is that also able to be tax deductible and that my wife and I are exempt from taxes too since it is also part of our sustenance and compensation for our productivity.

God bless,

Brian

-

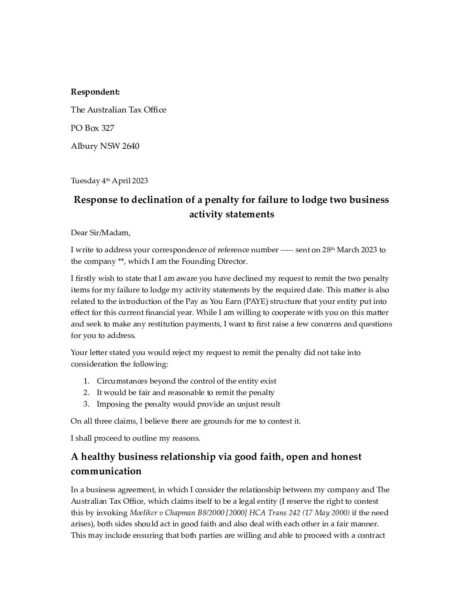

I’ve drafted a letter to seek the ATO to remit my penalty notices for not submitting my Business Activity Statements promptly and also requesting that they take me out of the PAYE structure.

Would love to hear your views on whether there is anything I need to change in there.

Thank you in advance for your time in reviewing this and providing your suggestions or comments.

God bless,

Brian

-

Following up on this.

Thus far, it has been a month since I sent my first letter seeking the ATO explain to me how they think that penalising me for a late submission of my business activity statements despite my company paying the GST owed to the best of our knowledge constitutes fairness, and also my query on how the PAYE scheme can help with promoting more business activity in such trying times.

The ATO has not responded to my first letter nor my subsequent notice of first default and seeking better and further particulars letter.

This week I am going to send my notice of second default to them.

I realised that my first letter only referred to the reference number of their letter to me notifying the penalties but I had not put at the letterhead my company’s ABN. Would that be grounds for them to challenge the validity of my letter and hence their lack of response?

I will include the letterhead with my company name, my title and ABN in the notice of second default and apologise for my lack of specificity.

Would that suffice?

Also, I am thinking that when I have the commercial power to declare my equitable remedy to the situation that I would convert their penalty of late lodgment fee to a sum certain amount of one dollar for each penalty notice and also my outstanding tax liability to a sum certain amount of one dollar, then discharge it with a cheque for three dollars, affixed with a 5 cent stamp.

Have I missed anything in this final process?

Thank you in advance for your response.

God bless,

Brian

-

These entities very rarely answer and if they do it is usually to make another more invasive offer or to bully and threaten. What we need to focus on is making sure our processes are competent and will hold up in court if necessary.

-

Thank you.

So from what I have uploaded thus far, anything you consider glaring errors?

I am about to draft my notice of second default.

This was my notice of first default and request for better and superior particulars.

God bless,

Brian

-

Here’s some suggestions to get you started;

Put re Before Penalty for failure etc at the top

Separate 4 into two questions

Have the date you are giving them to respond by

Put your details and mailing address and date at the top right hand side

Put all rights reserved under your signature

Outline what they need to do if they fail, refuse or neglect to respond.

-

-

-

In the Module 19 Options to Deal with Infringements there is a three step example of the process you are completing. I suggest you use those as templates for how to construct a Notice of Demand for better and Further Particulars and the following Notices. There are things you can change to make it more effective. If I was in your shoes I would buy that Module to give me a template to increase my chances of success.

-

Don’t hesitate to contact me once you have purchased that if you have any further queries.

-

Thank you very much for your time in going through my work and providing suggestions for improvement.

I have purchased the modules on 10 ways to settle a debt or liability and also on accepting public offer. Will purchase the one on dealing with penalties.

So given your suggestions above, do I need to reset the clock or can I proceed to notice of second default, incorporating what you have suggested?

God bless,

Brian

-

Hi Brian that is up to you. You can start again if you wish and include a letter of apology if you do so you can reset the default or you can proceed and apologise for any errors made in the first Notice to reset the default. If it was me and the errors were minor I would proceed with an apology if the errors were numerous then I would probably start the whole process again.

-

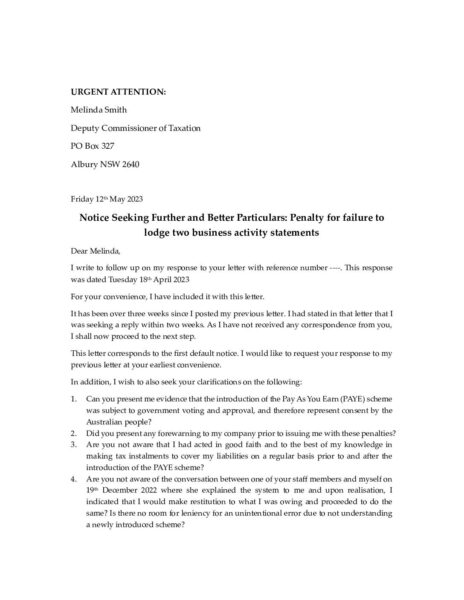

Here’s the draft of the latest letter I plan to send, using the template that I got from Module 19.

Thanks for your suggestions, Janet.

I have decided to proceed with the clock, but give them a bit more time and call this letter a follow up after the notice of first default.

God bless,

Brian

-

This reply was modified 2 years ago by

brianchu82.

brianchu82.

-

Hi Brian that is sooo much better. here are some suggestions that you can take or leave.

-

Thanks so much for your help!

I will make these amendments and then ensure this time I have a certified mail to ensure all the contents are contained within.

Hopefully things will travel well. The ATO needs a lot more pushback given the government is clearly using it to try to suck out more of our wealth and send it to Ukraine and whatever other corrupt entities that feed off of this behemoth.

God bless,

Brian

-

There is some really great information that you would be able to use in a meeting with the ATO if it comes to that. This is in Module 35 Settle Any Outstanding Matter with and Adversary at a Round Table Meeting. This information and questions to ask and how to ask them and how to set them up are gold!!

-

I’ll keep that all in mind. I hope to continue to do well with my stock investing to build up my wealth. Next step is setting up the unregistered trusts. Quite a few things to work on.

I can sense the developments in the world point to the cabal being really desperate as things are falling apart for them. Therefore we’re not far from a lot of things unfolding.

God bless,

Brian

-

Following up on this.

Got good news to share, or so I think.

The late lodgment penalties were supposed to be due on 26th May which is the 60 day period the ATO gave me to contest their penalties.

I had written them a notice seeking further particulars in April, followed up in late May, a second default notice in June and a final notice last Thursday. A notice of default judgment will be sent later this week.

I’ve not heard anything from them at all, no follow up noticed chasing me to pay up.

I’m assuming they quietly backed off on the penalty notices.

No news is good news.

God bless,

Brian

-

Well done, you will have an agreement you can use in court, if necessary, once the final default period for them to reply is up.

-

Well done Brian. good to hear of another recent favorable outcome, I’m currently in process of a P/N for liability with these pirates also. Agree with your Article today on the French, Nice work Its interesting Frederic Bastiat wrote a book “the Law”mid 1800s in that country about the same subject, a lot of revolt history in that country eh. Brilliant book too by the way.

-

Another update.

I have put David Allen on default for the outstanding tax liability. He continues to send me the monthly statement of accounts showing my existing balance with interest accrued.

I submitted my BAS to them for the previous quarter and they updated the outstanding balance showing the additional amount plus the previous liability plus interest. So I amend their statement of account to only accept for value the new tax liability from my most recent BAS and use a money order to discharge that liability. I included a terms of liability letter in the mail I sent to them stating that they have 72 hours to refuse payment but attached the BOE clause that states if they do then the payer is not liable given that it is a legitimate form of payment.

So far absolutely no ATO correspondence to state that my past money order payments were rejected and that I have refused to pay an outstanding tax liability. It seems like they are playing the game of saying this is how much I owe them while I send them the money orders for any new liabilities that crop up on my end. Only difference is I follow up with notices to put them in default while they haven’t.

Funny situation of a staring contest here it seems. First to blink loses.

What I am interested in knowing is at what stage will the ATO want me to deal with this matter. Or is this going to just keep going?

God bless,

Brian

-

Are you saying that you keep discharging every offer he sends you even if you have already previously discharged the amount he is claiming you owe?

-

Hi Morag,

No, I only discharge any new amounts that I owe if I incur additional liabilities from my BAS. I write down any outstanding liabilities they claim I owe and any interest accruing on those to be zero.

That way I don’t doublepay for previously discharged amounts.

God bless,

Brian

-

-

This reply was modified 2 years ago by

-

-

-

-

Good subject matter just wondering if some one has used a signed company seal and tax file number a dollar five being company liability