Homepage › Private Community Forums › Discharging Liabilities (Debt) › UK bank says it does not need to produce a contract

-

UK bank says it does not need to produce a contract

Posted by Mark-owen on June 5, 2023 at 10:32 amI sent a Notice of Conditional Acceptance to the NatWest regarding an alleged debt. I said I would pay up if they could show me the original contract to verify their claim. They said they have lost the contract and say they don’t need one under the UK Consumer Credit Act. Does anyone know what they are talking about? Please see first paragraph of the letter they sent me.

Mark-owen replied 2 years ago 2 Members · 5 Replies -

5 Replies

-

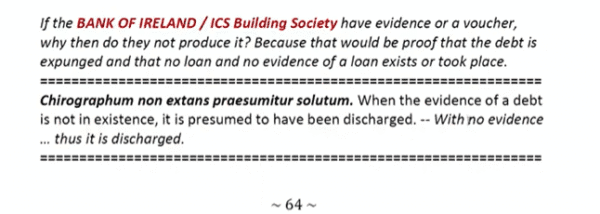

of course they will say that, there is a legal maxim that covers this, i used it in my paper work discharging my credit card, for give my not having it to hand , i don’t have the exact wording …

“if a contract is not produced it is taken that the debt is discharged.”

-

here it is, and the link to the whole talk

-

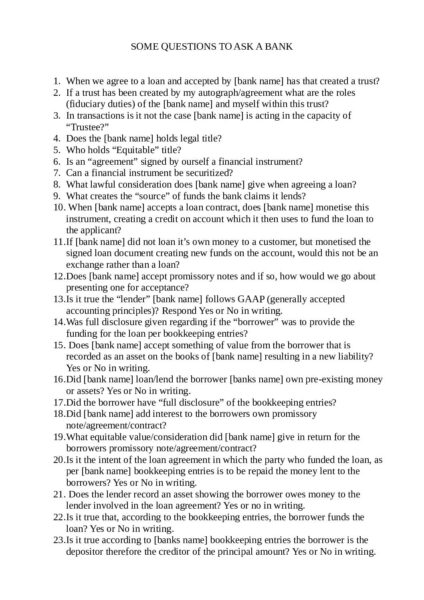

here’s a smattering of questions to ask the bank. when i wrote my notice to bank my intention was crystal clear , I’m going to place them in a difficult position, that no bonefide contract had been ever made. i chose from the list the questions i understood would do that. i “wanted to find a honorable solution to my account and i required them to produce the original contract that gave rise to the aledged debt.” (add maximum )

i think Morag has a copy of it “peoples success” if it helps

-

one more thing, did your document package include an affidavit of status?

my notice to the bank was accompanied with the affidavit of status in which i invited them to rebut all, points, one of which made the claim that i had no contract with the bank.

-

Hi Kari,

Thanks so much for the replies. I’ve been having problems posting replies here. I’ll watch the video and think through your suggestions. What stage are you up to with your dealings with the ‘lender’?

I have finished a 3-stage Notice of Conditional Acceptance, including default and final Notice. The bank shows no signs of backing off. I’m not sure to add additional Notices with further points and questions. Here is what I included in mine:

———-

To affirm the intent of any written communication is bona fide, sincere and not misleading, we direct you to deliver to us within an equitable time of 14 days of the date of this Final Notice which is 17 April 2023, your evidence sustaining your claims as follows,

1) You provide us with the contract document showing full disclosure that a lawful contract was made including terms and conditions and including my signature on it.

2) Is it not the case that for an agreement to be legally binding there must be consideration, and intent to contract? Are you making a claim that consideration was brought to this “repayment programme” by both parties? If so send proof of your claim.

I don’t recall seeing a document for this “repayment programme” agreement but if you claim there was one return it to me so I can see if there was full disclosure of intent to contract.

3) If the “repayment programme” agreement was in relation to and arising from the account number quoted as your reference then send me the original contract document, including full terms and conditions, with my signature on it.

4) Provide answers to the following questions:

a) Was either the alleged repayment programme agreement or original credit card contract ever sold, securitised, or monitized resulting in the title for the alleged debt belonging to or transferring to a 3rd party?

b) Is it not the case that the initial signature by the ‘borrower’ on a credit card makes the ‘borrower’ both the originator and creditor of a bill of exchange for example a promissory note at time of signature and this is what happened to either or both of these alleged agreements?

c) In previous correspondence from Lynda Darby in your organisation dated 15 February 2023 she advised me that “the card agreement has been misfiled”. Please confirm that this misfiling was not an entry of these bills onto an off-balance sheet ledger.

———–

The stuff regarding the repayment programme was regarding a form they asked me to fill in for “Income and Expenditure” for the purpose of deciding what amount I could repay. They seem to be attempting to use this as an agreement AKA a commercial contract (re contracting with me). I tried to attach the letter here that prompted my 3 Notice process but it failed to upload. But the relevant content of it was… “We agreed a repayment programme to assist you in repaying the outstanding debt. We are concerned to note that the agreed monthly amount has not been received. Unless payments are immediately brought up to date and maintained at the agreed level, then we will have no alternative but to consider further action on this account.”

FYI I didn’t include an Affidavit of status. I’m not sure what this is. Perhaps it’s explained in the video you have linked. If not would you mind telling me more about this?

Thanks again,

Mark

-

-

-

-