-

ATO claiming overdue company tax liability settled already by money order

Hi everyone,

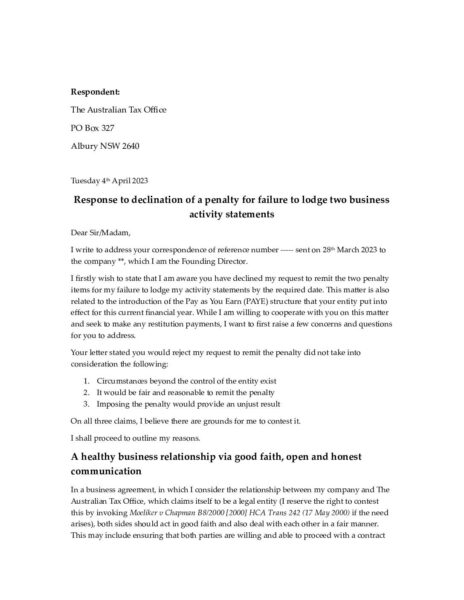

So back in June and July, I used three money orders to settle my company’s tax liabilities by drawing funds out of my fictitious corporate entity using the acceptance for value approach.

I used a tracked mail to send to them and it’s confirmed that the ATO received all the mail.I received no reply or protestations from them after 72 hours of them receiving it.

The ATO sent me an overdue notice early last month and today stating on my tax liabilities. On both occasions it has stated that I need to pay these liabilities or else it could commence action to take it from my private account if necessary. So far they have done nothing.

On each occasion, I have notified them that I have discharged it using money orders, refused consent to them taking anything from my personal or corporate accounts and put them on default judgment, including my conditions.

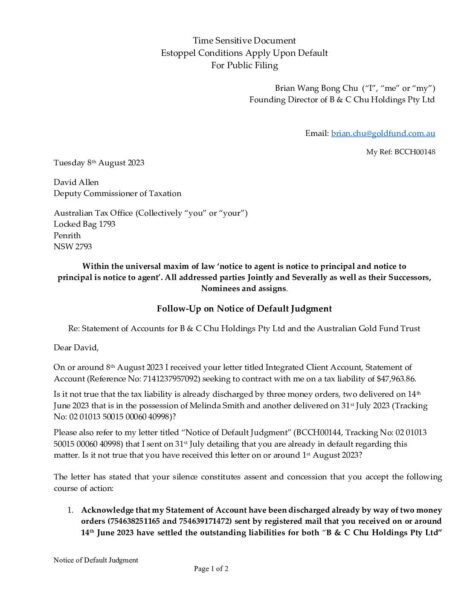

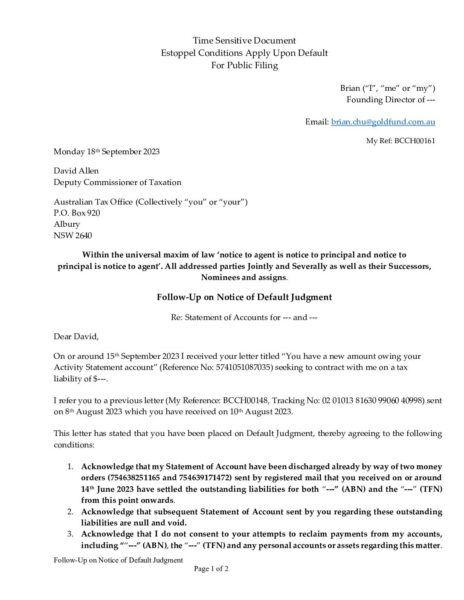

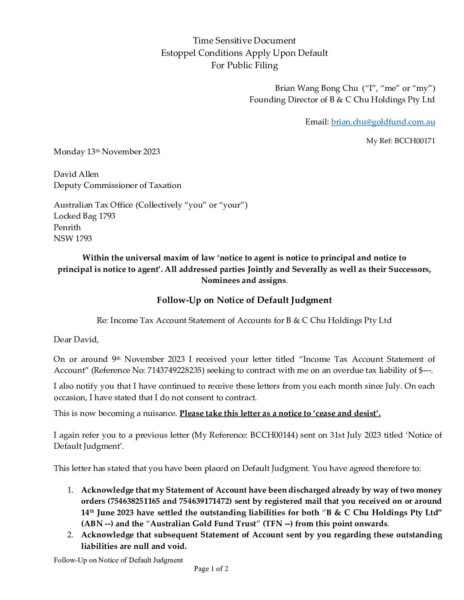

I attach my letter showing the initial Notice of Default Judgment and also the Follow-Up Notice of Default Judgment on them sending me another Overdue Notice.

I have also made good to send an invoice to them for engaging me after putting them on default judgment. They obviously have not replied or made any payment.

I attach my Notice of First Default for them not paying.

If anyone like to review and make suggestions for improvement, I would much appreciate it.

Thank you in advance.

God bless,

Brian