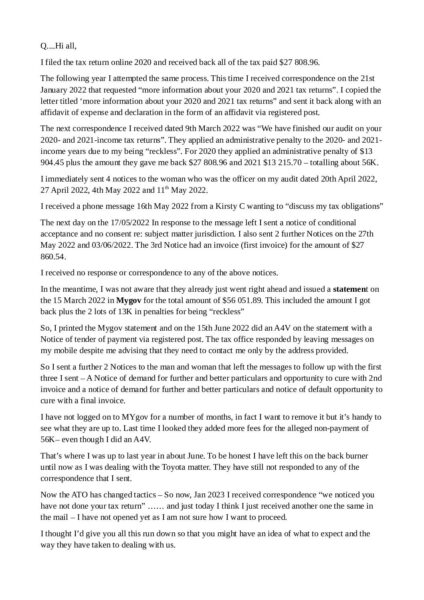

Homepage › Private Community Forums › Minimising Tax › ATO called my sister in law on her tax return

-

ATO called my sister in law on her tax return

Posted by brianchu82 on November 13, 2023 at 2:25 pmHi everyone,

My sister in law received a phone call from the ATO seeking information to finalise her tax return. She used a similar method as we did. None of us were flagged by the ATO but the ATO chose to call her.

Any advice on how to do this? She has to call back by this Wednesday. She isn’t very articulate and she hasn’t internalised the material here.

Thanks everyone. Any help is appreciated.

God bless,

Brian

brianchu82 replied 1 year, 6 months ago 5 Members · 42 Replies -

42 Replies

-

have the ATO contact her by Mail? Then time can be given to considering what they sent and what the reply should be.

-

I don’t think she had received any mail from the ATO.

I suggested that she call tomorrow and answer to her name before asking what the ATO staff wishes to clarify by phone. If it is something complicated she can ask the staff to write a letter and give her time to respond upon her return from an overseas trip.

Thank you for your suggestion.

God bless,

Brian

-

She needs to stipulate in the phone call that she will only correspond through mail at [give her address]. She needs to record the phone call as evidence of her reply to them and she needs to state before talking to them ‘This call is being recorded for training purposes” Then she can hang up and not answer any questions. If they ask anything she needs to answer it with a question eg “Did you understand what I just stipulated to you, I need everything from you in writing from now on, do you understand?” “Yes” “Thank you, goodbye” Hang up!

-

-

one approach that your sister could use..not that she has to justify why she wants to be contacted by mail only, is (for her to say to them) that there are so many scams going on out there that how do i know who you say you are…and its true…how many scam texts claim to be the ATO. anyway, good luck

-

-

Ok, so the ATO has emailed her seeking her to prove her work-related expenses. This includes requiring work invoices, receipts and reasons for why these are work-related expenses.

Will it be adequate for her to present her receipts for her living expenses and explain using a Statutory Declaration that these are the expenses incurred by her as a living woman to engage in commercial activity under her fictitious entity?

What other defenses can we provide? She is an employee in a company.

I am aware that in the past that some of you here were able to satisfy an ATO audit by declaring your expenses are used for sustenance. What pushback did they give and how did you manage to navigate it?

The ATO agent stated that if they aren’t satisfied with the proof, then they will simply disallow those declarations.

Any help is appreciated.

God bless,

Brian

-

She needs to have evidence of her work related expenses and they need to be tax deductible (she’ll be able to look up what is tax deductible in the tax information online, sometimes it changes year to year). It also depends what category she is in as to which expenses are tax deductible eg self employed people in NZ can claim petrol, lunches, seminars, travel, hotel expenses etc Employees don’t usually have as many things they can claim as expenses. Receipts are evidence, a stat dec will not be enough for work related expenses. She is doing business with the tax Dept as a strawman, they can’t do business with the living. The tax department is a dead entity also. We only interact as men and women when we are being forced into a contract we did not agree with or similar approaches. If your sister in law is an employee/dead entity and her entity has a tax number and she has filed tax returns as an employee in the past then she has agreed to do business with them. Some one else on here may be able to help her if they have been in a similar situation.

-

Her job largely allows her to work from home. Therefore I think we will go down this path by stating that she was given permission to conduct her work activities at home. She can also show email trails where she sends them in the evening too. She works hard, usually many more hours than 8 a day.

I own a registered company providing research on financial investments. I can draft her a report stating how we estimated her work at home expenses based on the market value of the home she lives in and then add to it part share of electricity, water and gas. I’ll state she has a suite in the house to perform her work including a bathroom. And since she isn’t required to work from the office, occasionally she can claim petrol expenses to conduct work in other places.

I’ll then have my company issue her a letter showing the calculations she can send to the ATO, complete with a receipt on payment she made for these services rendered.

Hopefully that works. What are your thoughts?

God bless,

Brian

-

So if we are not an employee to anyone, then we are able to claims a wider range of sustenance as other work expenses, is that right?

How does Mark’s seminar teaching us to claim sustenance as our other work expenses for the fictitious entity apply? And when do the affidavit of expenses or statutory declaration of expenses apply to offset our taxable income?

Thank you.

God bless,

Brian

-

hi Brian, I’m not sure of the tax laws in Australia (they are slightly different from NZ). All I know from my own experience is that I checked out tax deductible expenses over here and that is what I based my expenses on when I put in a tax return. Maybe ask Mark at the next Q and A?

-

The next Q and A is tonight and you can register here…If you let us know what he tells you that would be very helpful…..https://solutionsempowerment.org/event/general-qa-november-15/

solutionsempowerment.org

Access Restricted (Not an Active Member) – SolutionsEmpowerment.org

Access Restricted (Not an Active Member) – SolutionsEmpowerment.org

-

Sadly I am flying to HK right now and step off the plane around the time the Q&A session starts. I don’t plan to use roaming.

Perhaps I’ll see whether I can arrange a consultation session with Mark at a later time.

Worse comes, we can draft a letter presenting our information, apologise about how we can’t substantiate some of the claims in the filing and then see where they take it.

Anyone from Australia with the experience in going through a tax audit as an employee for part of the year?

I guess we can use the fact that start-up companies don’t earn any revenue and incur expenses anyway to substantiate some of her sustenance while as an agent of commerce seeking to do business with other entities.

Thank you though.

God bless,

Brian

-

To add, she stated her occupation was Agent in commerce. She was working with an employer for seven months of the year and was searching for work in the first five months. So is it possible to claim that while searching for work she was still engaging in business activities and therefore she is still incurring expenses to seek future income? Some start-up businesses are prospecting for income and incur expenses along the way, no?

God bless,

Brian

-

it all depends what is classed, under the Australian tax system, as tax deductible expenses.

-

Have you tried for yourself claiming sustenance for you as the principal creditor of the trust that is your legal fictitious entity as work related expenses? Or were you simply claiming the work related expenses that was allowed under the NZ legislation?

I figured that it’s about talking in the right language. We should train ourselves here to be precise so others will catch on. *Wink wink*

God bless,

Brian

-

Hi I completed a tax return for my contracting business before I knew anything about this information on this site. I kept all receipts and claimed all I could which greatly reduced the amount they wanted me to pay in taxes. They wanted to do an audit so I gave them all my records (I didn’t use an accountant and my records were all in order but it would have been a big job for them to go through them) and a month later they gave them all back without even looking at them.

-

Ah that explains it. You had kept up the practice of keeping the receipts as you ran a business.

Most people who don’t have a business are unlikely to do that and don’t realise that they can keep these receipts and then claim it as Other work related expenses when they reclaim their private identity from the public identity.

I think I know how to draft the set up questions for the ATO tax agent to answer in response to her requesting an audit.

The idea is that we show through our questions that we know we have two entities and ask if she wishes to deprive my sister in law of her sustenance paid through her public entity account. If the tax agent dares to do that, I’ll ask her the question of whether she is aware of the UN Declaration of Human Rights on depriving a man or woman of their sustenance.

God bless,

Brian

-

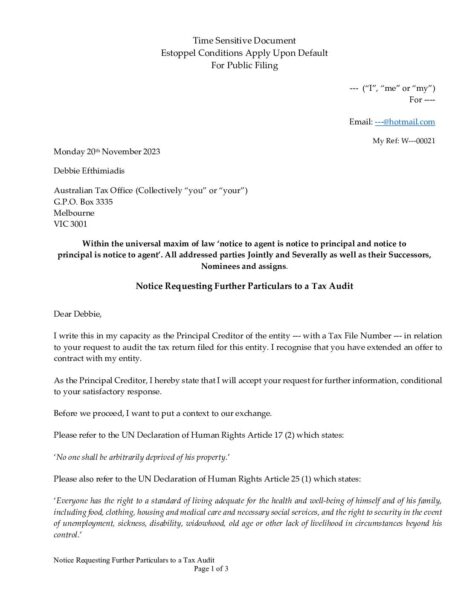

Here’s the draft letter that I am looking to send to the ATO tax agent.

I appreciate any suggestions and comments for improvement.

Thank you!

God bless,

Brian

-

This reply was modified 1 year, 7 months ago by

brianchu82.

brianchu82.

-

This reply was modified 1 year, 7 months ago by

-

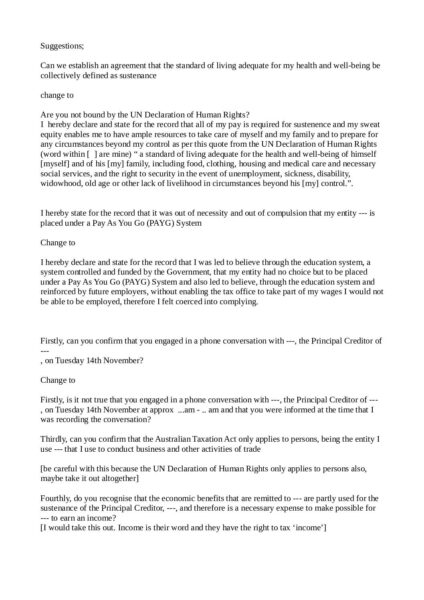

A better version without needing to refer to a Stat Dec.

-

Here are some suggestions

-

Thank you for your suggestions and explanations.

Let’s see how Debbie will respond. She wanted to make extra work for us, we will give her even more.

God bless,

Brian

-

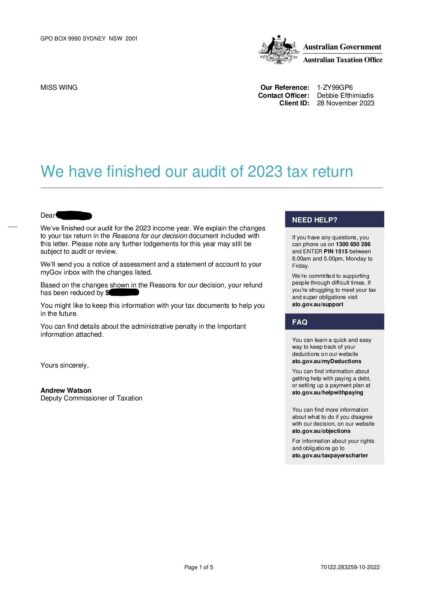

Hi Morag,

The ATO responded to my sister in-law’s letter today. They decided to proceed with changing all the deductions requested for review to $0 and hence reduced her tax refund. Then they decided to impose a 50% penalty claiming that she was reckless with her preparation.

Here’s the letter she received, with the personal details blacked out.

In a way we expected this is what they would do. However, it is disgusting that they run roughshod on this and act as if they are the final authority.

What else have you and others done in response to these? The problem is that my sister in-law was audited before they processed her tax return. So they had withheld her funds first and want her to submit information to get back what belongs to her.

Love to hear your views on how to proceed.

God bless,

Brian

-

Here are some different ideas and points of view.

-

I guess the tough bit in my sister in-law’s case is that the ATO made her undertake the audit with her funds withheld from her. This was kind of running the gauntlet and she got caught while several got through.

While the amount isn’t much – $2,400, it is an uncomfortable feeling that some of my friends and my wife and I succeeded thus far but she didn’t.

I know that the ATO can technically come back to us seeking us to provide evidence to back up our claims but the cash is with us and we can easily reject their open contract.

God bless,

Brian

-

-

-

-

-

-

-

Has she completed her affidavit and sent it in with her return? If so, there should have been a cover letter with it where she states that she only does business in writing, along with other matters. I received a full return of all ‘income tax’ for myself following this procedure, but they stole half of it by “Integrated Client account” to a partnership debt which was discharged by money order. We are still battling that one, but I need to complete my husband’s tax, then we may have remedy.

An audit is an offer to contract. Is it not true that they cannot come onto her property to conduct any audit without her consent? I’d be asking Mark for more information.

-

Hi…

We only sent the tax return where she signed it with “All rights reserved to the best of my knowledge as principal creditor”.

I am thinking that she can prepare the Statutory Declaration as a response to the tax agent’s audit. I was reading Mark Pytellek’s handbook that suggested if a tax return triggers an audit then take the path of the private acting on behalf of the fictitious corporate entity. So we can request that the tax agent present evidence that she has grounds to suspect that what my sister in-law has reported is otherwise.

The tough part is that the audit is happening before the tax refund. Therefore the ATO is dangling the carrot and holding the stick. All those I know so far who applied this got their refund back. And we hadn’t sent a Statutory Declaration. We simply signed it with “All rights reserved to the best of my knowledge” in our tax return form. Seems like my sister in-law was one of those randomly selected for an audit.

I guess if she doesn’t present evidence for those deductions, the ATO can refuse those items and therefore she doesn’t get as much refund as everyone else. It’s unfair, that’s for sure.

God bless,

Brian

-

-

Thank you.

Will you be attending the Q&A session tonight? I’d love to but I’m on a flight to HK touching down in an hour’s time. I won’t be able to make it.

Would you be so kind as to outline this situation with my sister in-law as a question to Mark for tonight’s session?

I am sure many people are going to appreciate Mark covering this.

So my question is:

My sister in-law followed the same procedure that was covered here in Solutions Empowerment. She received a call from the ATO seeking to get further particulars on her tax return. She had signed her name off in the form “All rights reserved to the best of my knowledge as Principal Creditor”. The ATO agent is now requiring her to present evidence of her declared work expenses including around $24k in “Other Work Related Expenses” that we had included as sustenance. She was employed for 7 months in the year and she doesn’t have enough receipts to back her claims of sustenance. She lives with my in-laws and pays the bills and part of the groceries at home, though it’s only recently that they started keeping some of the receipts.

Q1: What is the best way forward with the reply?

Q2: How effective would a Statutory Declaration claiming her identity as the Principal Creditor of the fictitious entity be in her reply?

Q3: Any other suggestions that we can take to try to get her over the line so she gets the refund?

Q4: Can she say that she is entitled to sustenance while unemployed is deductible because that is required for her to conduct business on behalf of her fictitious entity?

Thank you.

God bless,

Brian

-

This reply was modified 1 year, 7 months ago by

brianchu82.

brianchu82.

-

This reply was modified 1 year, 7 months ago by

-

-

-

Hi Lyn,

When you tried the procedure to get your personal tax return using the affidavit, did you do this in an audit or submitting your tax returns?

Also, there’s a chance that I’m travelling back from Macau to Hong Kong while Mark has his Q&A tmrw. Can you kindly cut and paste my questions for me please?

Thank you.

God bless,

Brian

-

-

-

Hi Brian,

I have issues connecting but I intend to watch tonight’s Zoom, and shall offer your question when I do. I have it copied ready to paste into the chat.

Cheers

Lyn

-

Thank you Lyn! Appreciate it.

Last week Mark’s session dropped out. I had posted three questions asking about signatures on official documents and on using my fictitious entity to pay corporate taxes which were lost. I had just arrived in Melbourne that evening for a work trip and needed to head out to dinner. Was quite disappointed the questions were lost.

Hopefully I can catch up to the recording for this session and hear Mark’s response to the questions for my sister in-law. We have just over a month to respond and we are all in Hong Kong these next few weeks.

God bless,

Brian

-

Extra Q and A this Wednesday!!!…… https://solutionsempowerment.org/event/extra-special-qa-november-22/

solutionsempowerment.org

Access Restricted (Not an Active Member) – SolutionsEmpowerment.org

Access Restricted (Not an Active Member) – SolutionsEmpowerment.org

-

Yeah… that’s good! Hopefully I can make this one.

God bless,

Brian

-

Excellent, and the Meeting ID and Zoom link is on the notice so we can join manually if need be.

Thanks!

-

-

-

My apologies, Brian. Yet again, I have no link to access Zoom so I miss out again.

Maybe someone else can post your question.

Cheers

Lyn

-

Oh.. That’s ok. He usually posts an invite by email and we have to accept the invitation before he sends the link to the Q&A.

-

-

I received the ticket and code but the zoom link doesn’t display.

The zoom link for last week only showed up last night so I don’t know what is happening

-

A couple of other members were having trouble last night as well, they contacted me about it today, but I’m not sure why it happened either.

-