-

Tax minimising vs tax evasion, what’s the difference?

Hi everyone,

I believe many of you have been following the saga over Hunter Biden’s scandals that include a multitude of things. Of one is tax evasion.

Now I’ve studied our modules over the past year on minimising taxes and I’m wondering if someone could help me unpack the puzzle of what is minimising tax and what is evading tax.

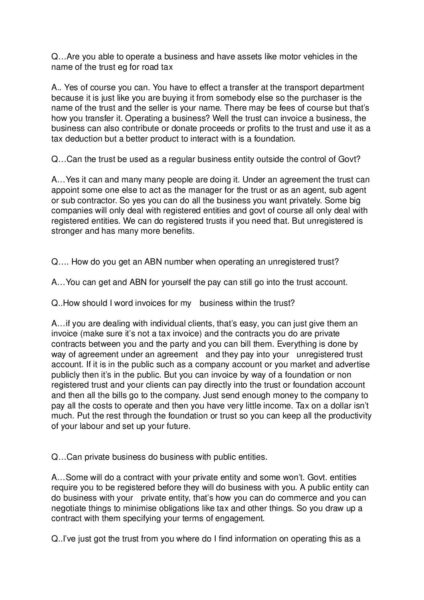

Mark has shown us that we can use unregistered trusts to help shift our wealth outside of their jurisdiction. He has also shown us that we can minimise our tax by defining “sweat equity” or “reward for our labours” so we aren’t reporting income. Plus, we may take the risk to apportion some of our sustenance as Other Work-Related Expense to reduce our taxable income to increase our refund.

What I am interested in getting your views is how does this differ from tax evasion?

If we know these methods, then why don’t the Bidens and countless others in the last century or so use this same method and therefore not face charges of tax evasion? Those guys are criminals and crooks. They know the rules as they make them or know the puppetmasters who did. What do we know that they don’t?

Hope to hear your thoughts on this devil’s advocate post.

God bless,

Brian