-

Great Southern Bank – trust bank account

Hi guys

I’ve decided to open another bank account with Great Southern Bank, for my trust, and close my CBA trust bank account.

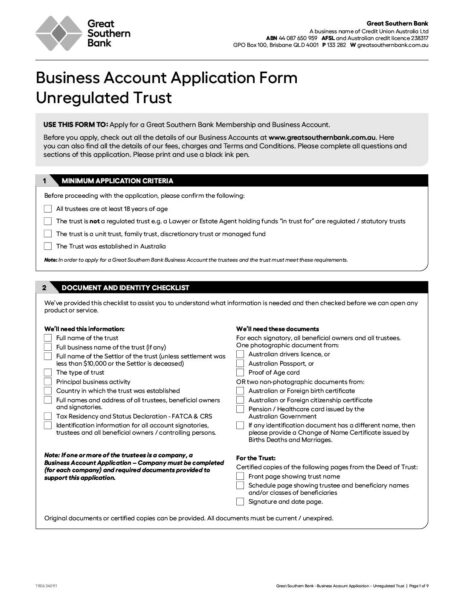

This is the Great southern Bank form for unregulated trusts.

I have a few questions others may have, and will add the form for people to see:

Q – 10 – ACCOUNT REQUIREMENTS:

They are giving the options of “Business bank accounts: , but also “Accounts for communities (if charity – or non for profit)”

Could I try request it as non for profit? And possibly provide no tfn or abn? It is estate and asset protection.

I guess they will definitely want a tfn? But not the abn.

I know with CBA they only do a business bank account.

Q – 3 TRUST DETAILS – Principal Business Activity:

I’m guessing this is where I put estate and asset protection?

Q – TRUST TAX AND FORIGN … is the trust an Australian resident for tax purposes:

Will I have to select yes here, I’m guessing I couldn’t open a bank account for it otherwise, or would it be okay for the trust itself not to be a resident?

Q- current residential address: I have a PO Box but I’m guessing I would have to use a home address to open a bank account, and gave the po box for mailing. has anyone used a PO box for the residential address and got away with it?

Q- 7 TRUSTEE DETAILS – Is the trustee a resident of another jurisdiction for tax purposes (almost end of page):

I am just curious as what this is, or if can I use this in some way?

Q – 9 , 13 : It asks “role” after each signature? Trustee?

-

This discussion was modified 1 year, 4 months ago by

Laura Adams.

Laura Adams.

-

This discussion was modified 1 year, 4 months ago by