-

INCOME TAX RETURNS

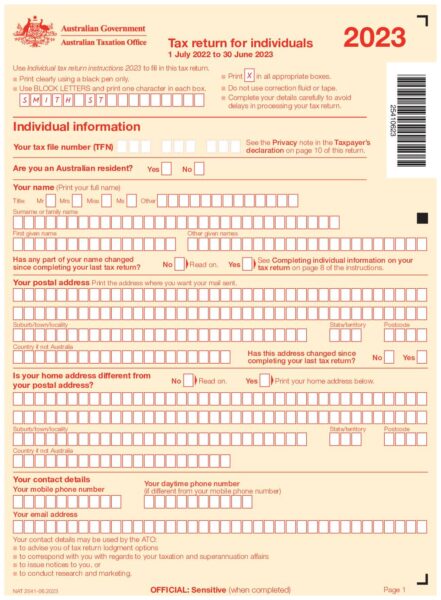

I recall a webinar for tax returns, to stop filing tax returns simply place a “X” where it asks if your doing a return next year. This releases you from their contract and you never have to complete another return.

We are a small business & have a public Trust, an accountant completes our returns each year.

I have noticed on the Trust return it asks –

“TYPE OF TRUST T – Discretionary trust –

trading activitiesIs any tax payable by the trustee? No

Final tax return? No “

However I can’t find the question of “FINAL TAX RETURN” anywhere on our individual tax returns.

1. Can I simply have the accountant put “Final tax return” “YES” on the Trust return only and not individual ones.

2. My husband thinks I’m crazy, and will not do this however the Trust is in both our names as a family Trust. How can I cease completing my tax returns & my husband continue doing his. Surely I can nominate not to complete anymore on my individual tax return only.

I did purchase the TAX documents from Solutions Empowerment some time ago, but the forms are different than what I receive from my accountant and there was no Trust forms enclosed in the package.

Anyway will be interested in any advice you may give.

Thank you