-

ATO response to a letter four months ago

Hi everyone,

Four months ago I sent a letter to the ATO seeking explanation regarding my company’s late lodgment penalty. In the letter I noted that the Mollicker v Chapman 2000 case where the ATO is not a legal entity. I also sought explanation regarding the conflicting testimony of two tax agents on my late lodgment penalty. I have also sent them three money orders for my company tax liabilities drawn from my legal fictitious entity tax file number to settle them.

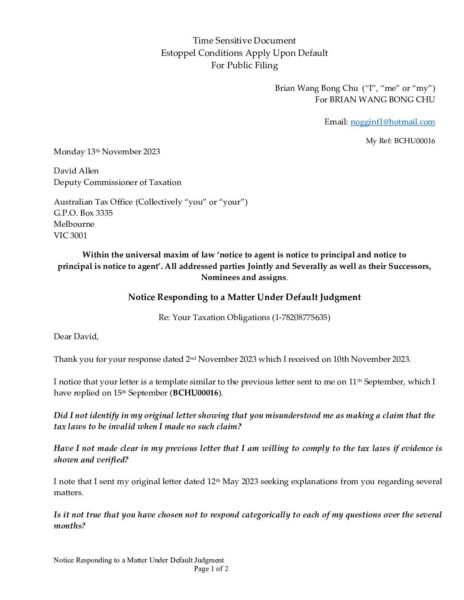

I have received this following reply which seems to only generally refer to my questioning of the ATO legality.

—–

We have reviewed your letter in line with the ATO Law Administration Practice Statement (PS LA) 2004/10 – Tax laws claimed to be invalid. This statement is published on our legal database which can be found on our website ato.gov.au by searching reference QC43599.

You’re not precluded from your taxation obligations by;

claiming tax laws are invalid

questioning the legality of the ATO

demanding ATO take actions or make payments, or

stating the tax system does not apply to you

It’s not the function of the ATO to enter into debate or give advice about issues not related to the administration of the taxation system.

It wouldn’t be our intention to issue a further response to any future similar correspondence.

Refusal to comply with your taxation obligations will not prevent legitimate action by the ATO.

—–

So what I am reading from this is that they are merely disagreeing with my questioning their legality but not the means by which I have made payments to discharge my company’s liability. Which means I can continue to do it and they will continue to accept it?

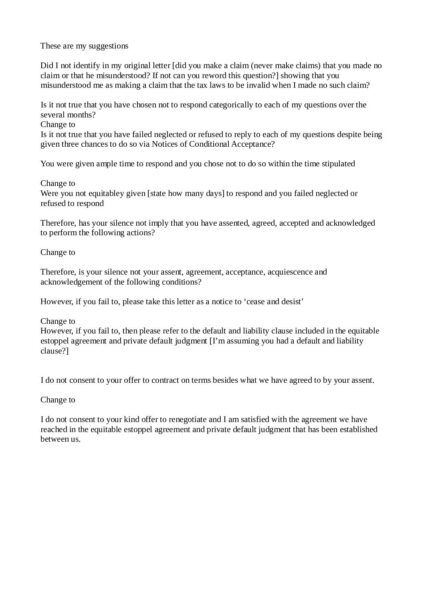

Should my response to this letter include letting them know that I recognise that I have the right to agree or disagree to contract with the ATO according to our mutually agreed terms. And regarding the ATO’s claim that there is no debate or giving advice between two parties in a mutual contract, I ask them to show me proof that I have at any time agreed to this condition? And where there was, I hereby waive that as it is not equitable.

I do not need to state anything regarding my payments because it seems like the ATO has quietly assented to those, having not sent them back and protested. Is that right?

Anyone else encountered a similar case where the ATO only disagreed about us questioning their legality but let the money orders and promissory notes they’ve made pass?

Thank you!

God bless,

Brian