-

ATO response to amendment of tax return

Hi there,

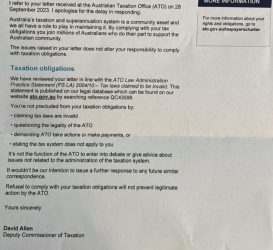

The ATO sent a templated letter responding to my friend and my amendment of past tax returns.

What we did was to send an amendment of past tax returns, provide the Statutory Declaration of our Identity as the Principal Creditor.

The letter referred us to the ATO Law Administration and Practice Statement (PS LA) 2004-2010 – claiming tax laws are invalid, claiming that we are suggesting the tax laws are invalid when we had not.

Here’s what they say, see attached.

Have others experienced the same?

What other approaches did you guys try and how did that go?

Thank you.

God bless,

Brian