-

ATO tax liability letters

Hi everyone,

As you’re aware, since last June I’ve used the BOE Act and sent my annotated Statement of Account for my company taxes and the postage stamps as acceptance for value method to discharge my tax liabilities.

Each month, the ATO would send me the monthly statements showing the balance continues to accrue for interest. I sent letters back to put the Deputy Tax Commissioner on default already.

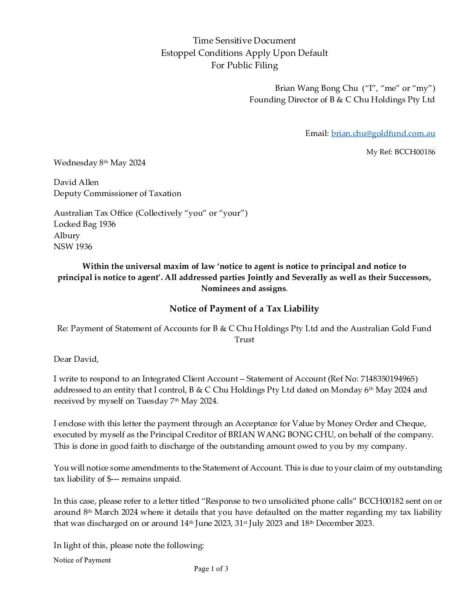

With each quarter, I sent in my BAS and then discharge the additional payments using the A4V method with postage stamps.

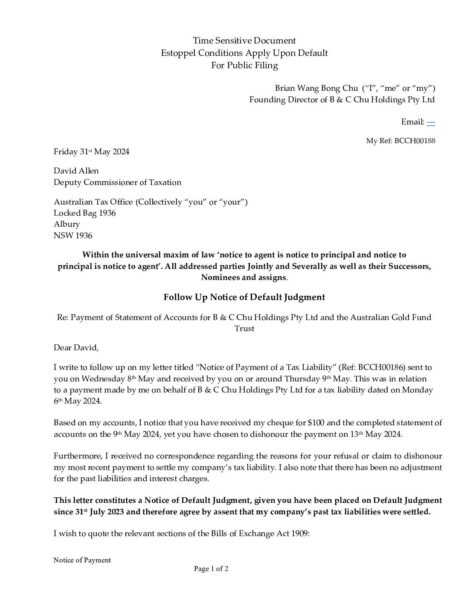

For the 2024 March BAS, I used a bank cheque of $100 to discharge my quarterly liability of over $2,000 which I had accepted for value for a sum certain of $100. I wrote an accompanying letter with my liability conditions that the $100 cheque discharges the quarterly liability if they bank it. I sent it by express post and saw that in my Statement of Account that the ATO had banked my cheque and reduced my liability by $100 when the ATO received it. But after the weekend, it decided to dishonour my cheque. I never received any correspondence explaining their reason for dishonouring a cheque when the account had a sufficient balance.

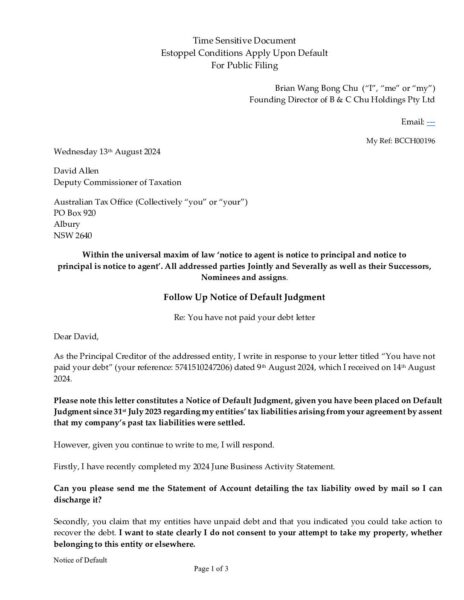

Since February, I’d receive maybe a notice warning me to pay my tax liability every two months. I just received one yesterday saying the ATO would take stronger action to recover the tax debt. Again, I responded with a letter immediately reminding them that they are on default judgment for ignoring, refusing and dishonouring my payments.

Never have I received any correspondence besides the templated sends from the ATO. No one ever wrote to explain why my claims are invalid or illegal. But I have diligently responded to them and kept a paper trail.

Anyone gone this far with dealing with company tax liability? Would love to hear your story.

God bless,

Brian