Homepage › Private Community Forums › Discharging Liabilities (Debt) › Credit Cards In Collections

-

Credit Cards In Collections

Posted by prizo on February 23, 2023 at 3:14 pmHello,

I have several credit card accounts that I have defaulted on and have gone to collections and are no longer owned by the bank but instead by collection agencies.

I would like to use the notice of tender payment letter to discharge the debt at a much lower amount.

Would this method still work with a collection agency instead of a bank?

Any help with this would be greatly appreciated.

yort replied 2 years, 3 months ago 4 Members · 21 Replies -

21 Replies

-

-

-

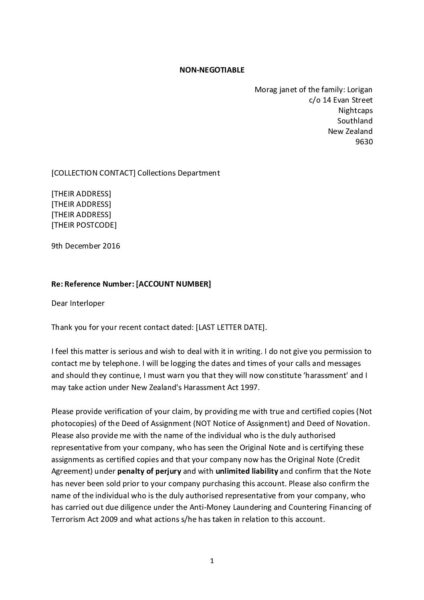

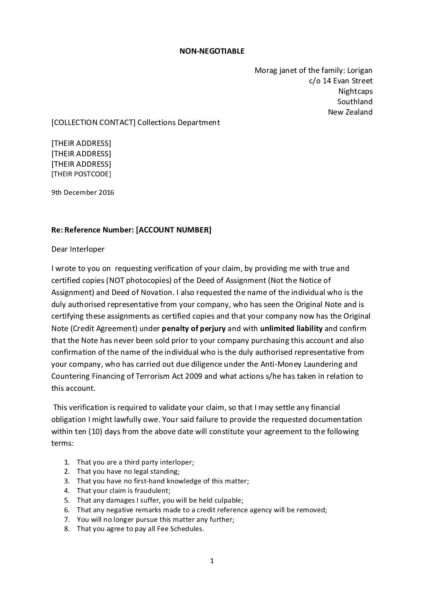

Wow, thank you so much for these documents.

I was wondering how to validate if these credit agencies truly owned my debt and these documents are perfect for that.

I greatly appreciate you taking the time to provide these.

Have a wonderful day.

Paul

-

Hello,

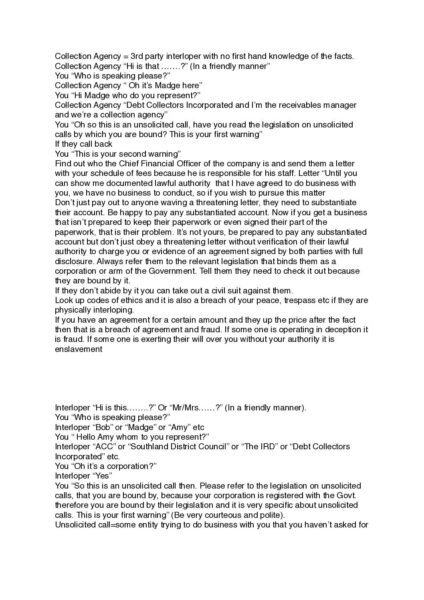

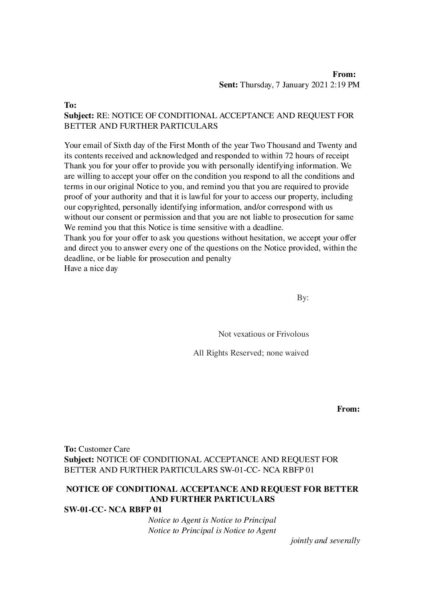

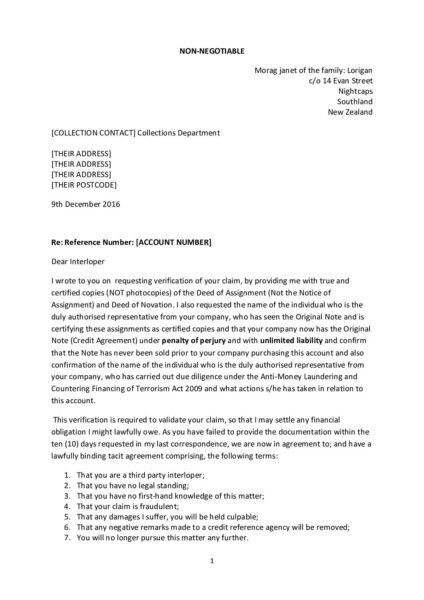

I’ve gone over the documents you provided and it seems like I should start with the one titled “Dear-Third-Party-Interloper-6.pdf”.

However I’m a little confused about the document as it looks like there are two documents in one. Also the formatting is a but jumbled.

I have a few questions and if you could provide some answers it would be greatly appreciated.

1. Is this the right document to start with considering that these “interlopers” or 3rd part credit agencies are just reaching out via letter at this point?

2. It seems like I can respond via email, is that correct?

3. Do you have a version of this document that is formatted a little better?

4. I see the text “SW-01-CC- NCA RBFP 01” in the document but have no idea what that refers to. Is it necessary and if so what is the meaning?

5. Finally it seems like no agency would be able to meet the demands of this letter. What should I do if they do not respond or if they cannot meet the demands?

Thank you for taking the time.

Paul

-

Hi if you want to change the documents you can, you need to start learning the processes by way of webinars where you will find the answers to your questions or make an appointment under the contact tab and pay for advice.These subjects can take a long time to work through and explain and the questions can be many and varied. Sometimes we just have to dive in and start learning by doing, after a lot of study of course.

-

There are remedies to all of the matters you bring up but not easy to explain in one answer.

-

have you watched these webinars and purchased the modules? http://solutionsempowerment.org/webinar-10-ways-to-discharge-debt/ http://solutionsempowerment.org/webinar-strategies-to-discharge-credit-card-debt/ http://solutionsempowerment.org/webinar-deliver-payment-by-way-of-promissory-note-to-discharge-a-debt/

-

Thank you for getting back to me so quickly.

I understand that I’ll need to do some more learning to understand how to properly apply these discharge process.

I did purchase something called Module 10 which was about discharging credit card debt about 1.5 years ago and haven’t gotten around to implementing it till now.

I’m going to watch the webinar you provided and if need I’ll pay a consultant to get some more help.

Thank you for your support.

-

Here’s a new discussion thread you may be interested in.

-

-

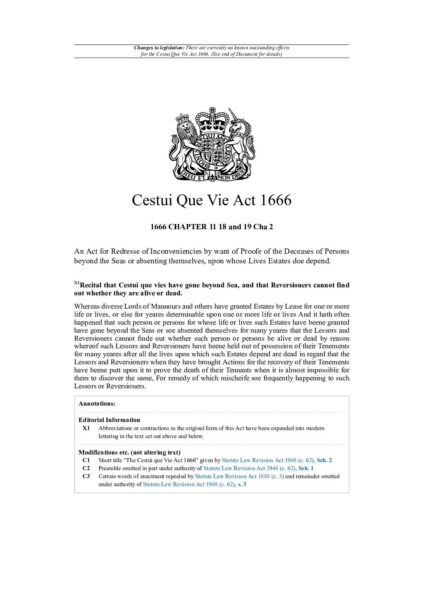

I’ve never heard of Cesti Trust account. Is there more to the discussion that what is in the PDF? Would love to learn more about this.

-

-

-

-

Thank you for the additional document. I will take the time to go over it and understand it the best I can.

-

-

-

-

Yeah, it sounds good. I’m interested in this as well.

Thanks for the PDF’s Morag.

If the supposed dead Man prove to be alive, then the Title is revested. Action for mean Profits with Interest.

Is this apart of the Fraud with the House loan? A loan set up with a dead entity, making the Lawyer, Bank manager and loan officer accomplices to the fraud?

-