Homepage › Private Community Forums › Holding Position & Settling Matters Privately › Dealing with debt collection agencies – holding your position

-

Dealing with debt collection agencies – holding your position

Posted by rtw711 on March 3, 2024 at 9:37 amI have just received a letter from a debt collection agency acting on behalf of the council requesting payment of part of the outstanding rates owing. Note, I don’t have a mortgage or any contract with the council to pay rates. I also offered to pay $10 per quarter for rubbish removal to fend them off. Any suggestions on how to deal with the debt collection agency acting on behalf of the council?

Note, I did the 3 Notice process (Conditional Acceptance, Demand for Further & Better Particulars; Default Notice & Final Notice) for council rates with notices sent to Mayor/Acting Mayor of my local council and have just completed that process where they defaulted on the 1st 2 notices. I have also commenced the same process sending the same notices to the CEO, a Council Revenue Team officer and the Revenue Team.

morag-janet-of-the-hill-family replied 1 year, 4 months ago 3 Members · 22 Replies -

22 Replies

-

These might help. Read them all the way through to find your answers.

-

Good info Morag. I brought a book called “defusing the debt bomb” from https://gaiauni.com/product/defusing-the-debt-bomb/ . No this guy learnt all his trick of Mark, but also this guys wife had been battling with debt collectors for years and he wanted to basically beat them at their game. This book as “I say Marks” 3 step process and it has a step by step guide. So it makes it easy to follow. I did and I kicked there butts. It was one of my first wins and for $3000 from origin. I also sent with the notices my schedule of fees and told them they had to remove the bad credit rating asap. But all that is in there it explains everything. Very simple process. No stress at all. BUT, I am not sure if the council has sold you debt to an independent debt collector. Morag I think is right up there with the councils. But first up you need to call the councils debt department and get proof of the sale of your debt. Origin sent me the details of the sale. Its not an issue if you cannot gets it but it helps. But if you can’t you send the 3 notices 14 days apart and they have to prove they have a contract with you that has your wet signature on it. If they can’t and they won’t. You win! easy. In you case as it is the council try and get the sale notice and you have every right to it as it was you debt they sold. Hope that helps. Bricky

-

-

Hi, M-J. Do you know if you need to respond to a debt collector’s letter within 72 hours of receiving it? I suspect you do.

-

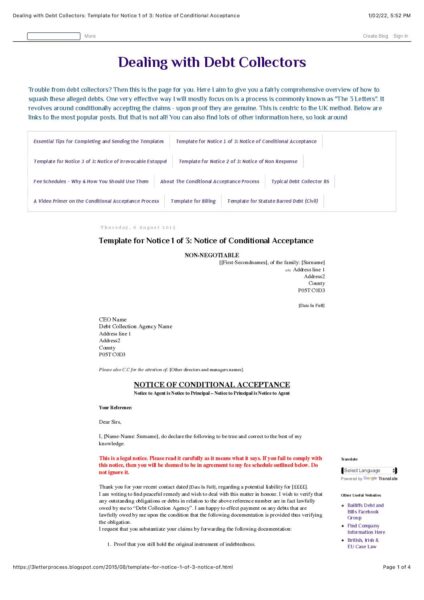

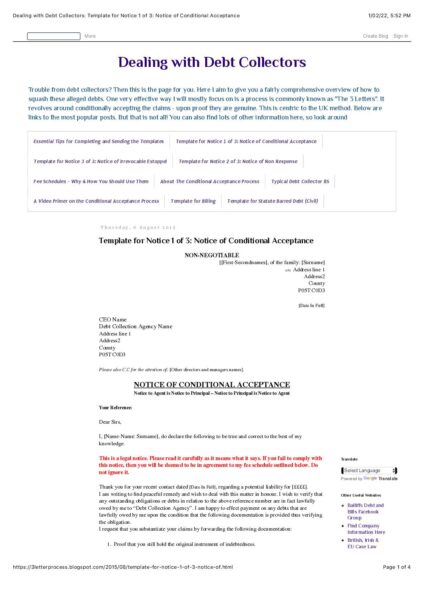

Yes, here’s a template from the UK, you could adapt it for Australia.

-

Thanks for the quick response M-J and your assistance with this matter.

-

When replying by email, if you cannot obtain the CEO’s email address but have an email address stated on letter from a debt collector, is it acceptable to use the admin email address and rely on admin forwarding the email to the CEO, writing the following in the email sent to the debt collection agency:

OFFICE FOUND

Attention: John Doe, Chief Executive Officer

Please refer to attached correspondence

Yours Honourably,

James Doe

Equitable Beneficial

Named Estate Trust Title Holder (not the Trustee)

Without Prejudice

I have used the above process previously without using “Office Found” (which I have since learnt to use) when addressing someone at a company. The employee received the email as it was confirmed by them in their written correspondence reply.

-

-

Humbly apologise if you reply late and this will reset the default. You need a good reason for the delay though.

-

-

Thanks Bricky. Very helpful.

Do you need to respond to debt collector within 72 hours?

Would you mind sharing your 1st Notice to Origin please. Okay to message me privately if you prefer. I am challenging my energy company, Energy Oz and they have so far refused to acknowledge my Express Trust Contract financial instrument I sent them to discharge my electricity liability. They have refused/failed to return it. I am escalating the matter to the CEO but not sure what I should put in the notice/letter to them. I have exhausted all other options after dealing with different employees from their customer Service and Accounts teams. Also, I didn’t realise you could get a bad credit rating from non-payment of utilities. From what you wrote, I must be mistaken. Is this for any unpaid utility bill? I have finished the 3 Notice demand process with my water company and have 2 unpaid bills now.

-

This reply was modified 1 year, 4 months ago by

rtw711.

rtw711.

-

Sorry I didn’t send a notice to Origin, if I said that, thats and oops. No called the debt department and asked them when they sold my debt to the debt collector. Then they sent that out to me. As for challenging the energy company, have you tried to discharge you bill with Energy OZ? or has that gone to a debt collector? Ok if your discharging it and its not with the debt collector thats a different story. Yes you can but origin did not give me the bad credit rating it was Panthera the debt collection agency so they had to rectify that. So non have gone to a debt collector?

-

You mentioned you had a win against Origin. Did you use the 3 Notices process? If yes, what financial method/instrument did you use for discharging the liability? What did you put in your notices?

Do you need to respond to debt collector within 72 hours of receiving their letter?

My energy debt has not gone to debt collector yet, only the council rates. I forewarned the billing/accounts dept of Energy Oz that I would be escalating the matter with the CEO if they didn’t return my Express Trust Contract financial instrument I sent them to discharge my electricity liability. They called it a letter which it isn’t and said they don’t accept it as a form of payment but have refused to return it. I have sent a number of letters as I am trying to resolve the matter peacefully but to no avail. Given this, what questions could I ask the CEO to hold them accountable?

Sounds like you are dealing with a very corrupt debt collection agency as they had no right to give you a bad credit rating. How do you remove the bad credit rating?

-

They are all corrupt rtw711, They are all fraudulent thats why when they get the debt you can say good by to it. I sent them the 3 step notice to conditionally accept the debt if they can prove I have a wet signature contract with them. And I don’t so I just sent the notices 3 times and then the affidavit confirm the process and their acceptance and that was it. Done like a dinner. Nope I didn’t respond to them in 72 hours I responded to them 3 years later. I did not know I had that debt and it was from leak in a house or something and they wanted me to pay $3000 for the months hot water bill. hope that helps

-

Thanks for the clarification bricky.

Yes, they sure are. No morals.

What initial notice did you use? The one that was in a pdf M-J posted above or a different one?

After watching a couple of the YT videos, it seems important to clarify if the debt was definitely sold to the debt collection agency.

Did you check that the debt was sold and the Debt Collector was not acting on the Original Creditor’s behalf as this should avoid any Statue Barred reset when contacting the Original Creditor, as they no longer “own the alleged debt”.

Did you ask Original Creditor, Origin the following questions:

1. Is it true that (Original Creditor name) ended/terminated the account when it became Defaulted?

2. Is it true that (Original Creditor name) marked the credit holders Credit Report/File as Satisfied/Settled when the alleged debt was sold to Debt Purchaser?

3. Is it true that the account with (Original Creditor name) is closed with a zero (£0.00) balance?

M-J above has clarified that you need to respond within 72 hours or send a humble apology which should reset the default.

Note, for my matter with the council, 1-3 above would not apply as the debt collector is only chasing the 2nd quarter rates even though I did not pay the 3rd quarter due on 1st March because in my 3 Notices I offered to pay on condition the council (Mayor/Acting Mayor) provide evidence of their jurisdiction over me, and to charge rates..

-

This reply was modified 1 year, 4 months ago by

rtw711.

rtw711.

-

HI I sent you the link that has the notices in, click on the picture in this chat and buy the ebook, defusing the debt bomb it has all the templates in it and step by step instructions.

Yes it is a good idea to get evidence of the debt being sold but some times you can’t, and thats ok. You still state it in your notices. Because that is the only way a debt collector can get you debt, is to buy it for 10c in the dollar of the owner of the debt. Then the original owner writes it off as tax debt,

A debt collectors will aways say they are acting on behalf of the owner of the debt like Origin. But they are not at all. they are lying.

All I ask origin was, when did you sell the debt.

Yes M-j is right in most cases but with a debt collector it is different. I would read that book, defusing the debt bomb it explains it all. This guy know everything there is to know about debt collectors as he has been dealing with them for 20 years.

Do the same thing with the council and ask for the date they sold your debt to the independent debt collector. I do know that some don’t go to actually debt collectors they have a debt department they send the bill to for them to sought out so you my need to find that out. But thats all I can tell you really.

-

Thanks for all this info Bricky. I will call the council and ask them for the date when they sold the debt.

-

This reply was modified 1 year, 4 months ago by

-

-

Do you know about the statutes of limitations? Well when you have a debt the debt collector even though they are fraudulent will chase you for 6 years. if they don’t hear from you the debt is automatically dropped. So say I hadn’t contacted them for 3 years, I only had 3 years left before it disappears under the statutes of limitations. But because I contacted them the debt starts the clock all over gain giving them 6 years to harass me. But this time I had a 3 step process that got rid of them in 3 months.

-

I have heard of the Statute of Limitations but was not aware of starting the clock again if you contact them. At least you were prepared the 2nd time round.

-

-

-

This reply was modified 1 year, 4 months ago by

-

-

You could also add this in if you want to at the bottom of the email…

This email message (including attachments) contains information which may be confidential and/or legally privileged. Unless you are the intended recipient, you may not use, copy or disclose to anyone the message or any information contained in the message or from any attachments that were sent with this email. If you have received this email message in error, please advise the sender by email, and delete the message. Unauthorized disclosure and/or use of information contained in this email may result in civil and criminal liability.

-

Thanks M-J, that is very helpful. I will include that in my emails from now on.

However, my main issue is it legally valid to send a letter/Notice addressed to CEO to the company’s admin email address where the Notice is time sensitive with estoppel conditions (e.g. a Notice of Conditional Acceptance) and rely on their admin team to forward that email on to the CEO and if they don’t then that’s their problem not mine. I’m trying to cut down on postage costs as I am currently unemployed. Do you see any issue(s) with sending an email to CEO via admin email writing the email in the following format with your legal clause included at the bottom of email?

OFFICE FOUND

Attention: John Doe, Chief Executive Officer

Please refer to attached correspondence.

Yours Honourably,

James Doe

Equitable Beneficial

Named Estate Trust Title Holder (not the Trustee)

Without Prejudice

-