-

Discharging liability with a BOE (q voucher)

Hi all,

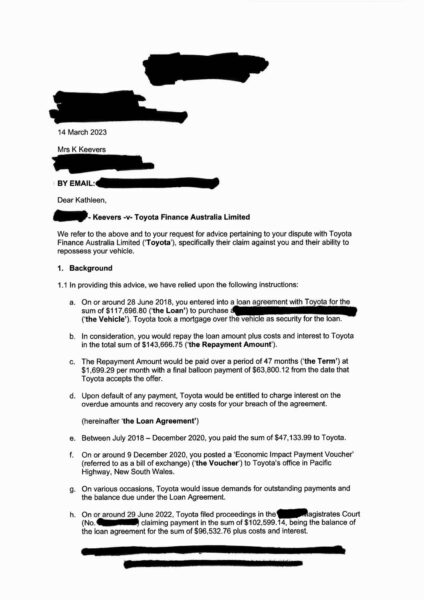

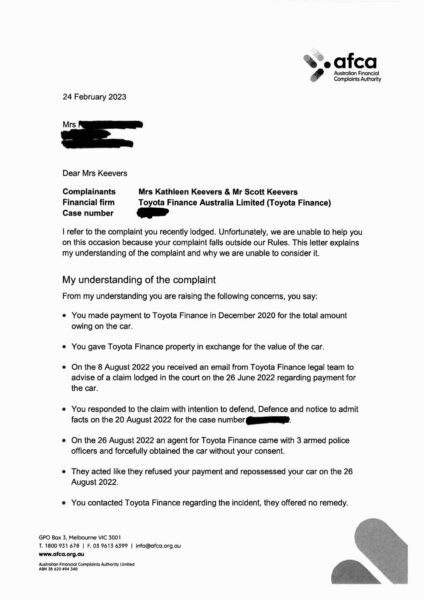

In December 2020 I used a q voucher (BOE) to discharge a liability with Toyota finance. To date I sent around 16 Notices including irrevocable estoppels to the company’s, company’s agents and employee’s – they maintained the voucher was ‘not legal Australian currency’ and ‘not valid under Australian law’. They have never responded with proof of their claims.

The last notices I sent included invoices. These letters were sent to the company, various debt collectors, agents and employees with no response. They were now in default.

Despite all of the notices they still listed us as default debtors with Equifax.

I recently sent a few letters to Equifax as I wanted to wrap this up and force Toyota’s hand to finalise this once and for all. In these letters to Equifax, I instructed them to list Toyota as a default debtor. A week later Equifax notified me that the listing had been removed. I was happy about that outcome and thought I was making progress.

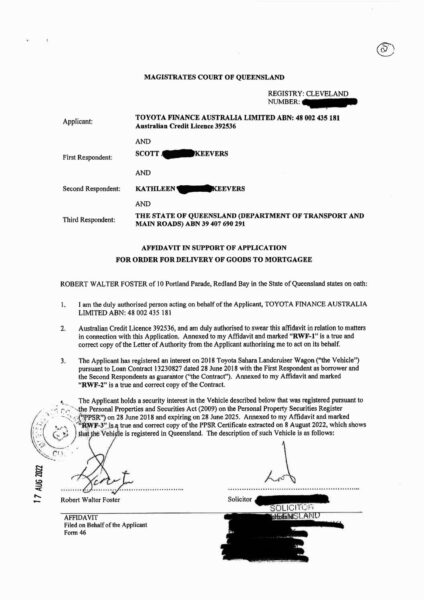

A few weeks after that I became aware that there was a claim submitted to the court 26<sup>th</sup> June 2022– we were never served however the company’s lawyer emailed me the claim well over a month or so later on about the 8<sup>th</sup> of August 2022.

I submitted the intention to defend and defence AND a notice to admit facts on the 22<sup>nd</sup> of august 2022. I was yet to submit our affidavits but all of this process takes a huge amount of time!!. I intended to get it in before the 28 days. I probably should have filed a defence and counterclaim straight away as Mark suggests however at least I managed to get in a defence.

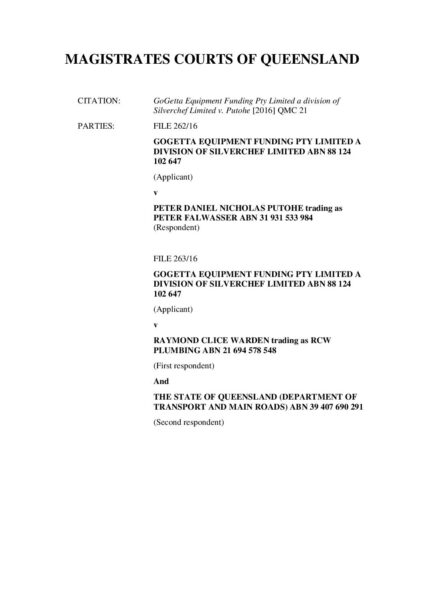

A few days later at my work place a debt collector turned up with 3 local armed police with a tilt tray and repossessed my car!!! They claimed they had a valid court order. I did not consent to the removal of my property or the court order to remove my property and I took a video of the entire process. The senior police man told me the court order was lawful and that I would be arrested if I didn’t move away from the property. The court order was dated 26<sup>th</sup> of august 2022 and was made by a different lawyer at a different location from the lawyers that submitted the claim for the company……. This was in the car park at my work place. The gossip of course has spread rapidly – it’s a small town. However, we are still holding position.

We contacted Toyota to make a complaint and to ask if we could pay to receive back our property and they said, “we have the car, as far as we are concerned the sale will cover the debt”, you “should receive an email to say we have removed our claim”. A day later again contacted Toyota to ask if we could pay to receive back our property. They said there was already an active complaint in regards to our “account”. We did not get any remedy from this phone call. We recorded this call as well.

I have yet to see this email stating that they have removed the claim, however when looking it up on the court under the court number there is nothing listed. Despite this we also managed to get the affidavit for the defence and exhibits to the affidavit filed in to the court before the 28 days were up from the date of the email the lawyer sent us on the 8<sup>th</sup> of August 2022….. just in case they applied for a default judgement?? against us and didn’t remove the claim??? Forgive me I am learning on the run I don’t really know what I am saying!!

They also said we have 21 days before they are allowed to sell the car?

They have not responded to my notice to admit facts in the 14 days from the 22<sup>nd</sup> August 2022

They have not responded to my affidavit for the defence

Therefore I am still submitting an application for summary judgement with affidavit this week – even if there is apparently no claim on the court website.

Questions:

How do I get my car back? Is there a court document I need to submit?

Can they seize my car when there was a claim made by them and my Defence in the court in regards to the property?

Can they withdraw the claim when I have put documents in the court in regard to the claim?

Can they deny me remedy, keep the car and sell it?

Have a private meeting with Mark on Thursday but thought I’d put it out there to all. It’s nice to read through what other people are doing

Kate