Homepage › Private Community Forums › Minimising Tax › Letter from ATO

-

Letter from ATO

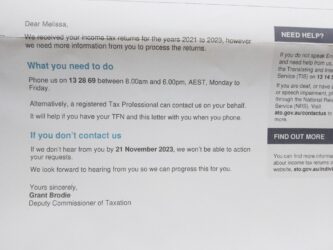

Posted by Melissa on November 27, 2023 at 3:29 pmI have recently received this letter from the ATO. I checked my mail last Thursday (24/11) so, naturally I’m late responding to the ATO since they wanted me to phone them by 21/11. I would not like to phone them because I’m worried I might say the wrong thing.

I’m thinking of replying to this letter and asking what information they need. I’m surprised they didn’t just email me.

I’m posting this issue to see if anyone has advice or tips on how to deal with this letter from the ATO.

Cheers, Melissa

morag-janet-of-the-hill-family replied 1 year, 6 months ago 3 Members · 12 Replies -

12 Replies

-

You don’t have to phone them it’s an offer.

-

Update: Yesterday I received a ‘Notice of assessment’ for the tax year 2021 in the mygov inbox. If i’m correct, that means they processed this tax return.

I’m still planning on responding to the letter since the year 2022 & 2023 haven’t been processed yet.

-

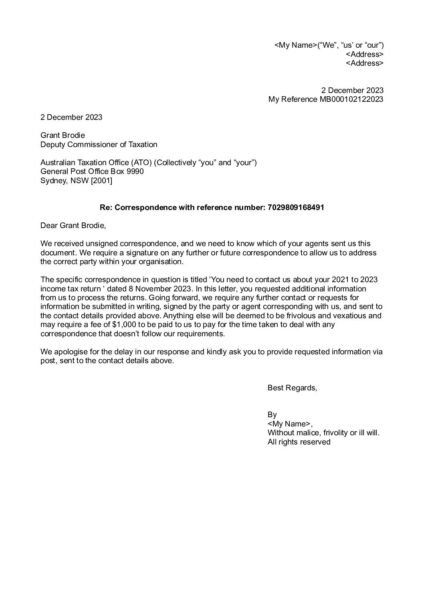

Attached is the letter I’m sending to the ATO regarding their request to phone them for more information.

Any feedback is appreciated!

-

This reply was modified 1 year, 7 months ago by

Melissa Bockelmann.

Melissa Bockelmann.

-

UPDATE: I thought I would update my original post regarding sending a letter to the ATO. I ended up sending a letter, but of course, I got no response. (see example letter attached) I’m not sure why they sent me this letter in the first place, since they haven’t followed up on this.

Thank you again Morag for your suggestions! I did use some of your suggested wording.

-

This reply was modified 1 year, 6 months ago by

Melissa Bockelmann.

Melissa Bockelmann.

-

This reply was modified 1 year, 6 months ago by

-

This reply was modified 1 year, 7 months ago by

-

My sister in-law got the same. She responded with a letter asking for further particulars after she spoke with the ATO agent about the audit. The ATO agent responded to that letter by zero-ing all her deductions and slapping her with a 50% penalty.

The problem is that the ATO auditing you when you are a PAYG employee is that they hold your cash and dangle in front of you as a carrot. Then they break their own rules and cite their own rules as to why they are legitimate.

Mark has an updated Q&A in July 2022 about minimising taxes. He says that what is happening to my sister in-law is now more common, 30% of the people trying to minimise taxes by claiming sustenance under Other Work Expenses succeed without questions asked. The others will have to simply set up documents to hold back on any penalties the ATO imposes for “reckless behaviour”.

The ATO is disgusting. I hope for poetic justice to hit the agents who work there for a longer time as they are wilfully participating in this. From what Mark says, the turnover is big there, probably because those with a good conscience won’t remain there.

God bless,

Brian

-

I agree, the more we deal with these entities the more we realise they are willing to blindly obey orders and to not follow proper procedure. On the plus side it requires us to learn and research and once we have done that , then we can hold our position for as long as we need to, or to find other alternatives and pathways to get a result. In so doing it allows us to help our fellow man when they need answers.

-

-

-

-

This is only a suggested change of wording in this section… ‘We received unsigned correspondence and we need to know who is responsible for this. We need to know which of your agents sent us this document and we require a signature on any further or future correspondence to allow us to address the correct party within your organisation’ then ‘We received this correspondence titled “blah blah blah” and we need to know who is “you” and who is “us” I require any further contact or requests for information to be in writing signed by the party/agent corresponding with us and sent to the contact details above. Anything else will be deemed to be frivolous and vexatious and may require a fee of $1,000 to be paid to us to pay for the time taken to deal with any correspondence that doesn’t follow our requirements’ [whatever address you have on the letter] Then I would finish the letter as you have done. As I say it is only a suggestion.

-

-

May I ask why is it important that any agent of the ATO signs any further correspondence? Has it something to do with taking responsibility on their end?

-

Yes, it allows you to hold them personally liable for any unlawful or fraudulent or other behaviour that harms you. You need a living man or woman to send Notices and Affidavits to if necessary. You can also send them a bill for any harm caused once you have an agreement with them. If you don’t have a name you have no proof of who it is that is behaving in a manner that harms you and cannot hold anyone accountable. An unsigned document holds no weight, if you didn’t sign your letters and Notices or name yourself in them then how could anyone contact you or reply or have an agreement with you or challenge anything you said?

-

-