Homepage › Private Community Forums › Minimising Tax › Minimising tax – Completing ATO tax return – Supplementary section

-

Minimising tax – Completing ATO tax return – Supplementary section

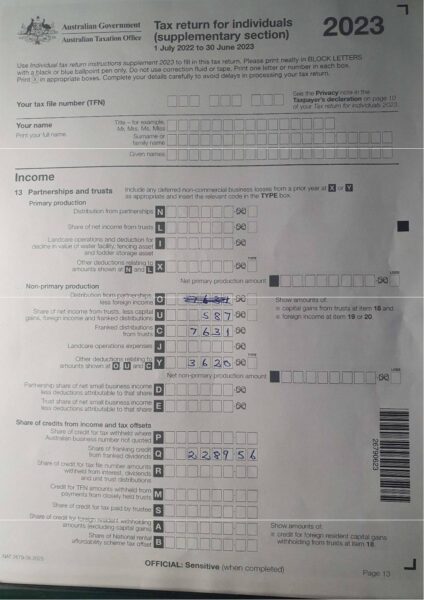

Posted by rtw711 on December 27, 2023 at 12:32 amIn the “Instructions To Complete Returns” document in Module 2, there is no instructions for filling in or completing the ATO Tax return for individuals (Supplementary section). I have a share investment portfolio managed by a financial adviser which usually requires me to complete this Supplementary tax return form. How should this be filled in? Would you still complete it as you normally would? I have attached it below.

-

This discussion was modified 1 year, 6 months ago by

rtw711.

rtw711.

brianchu82 replied 1 year, 5 months ago 3 Members · 7 Replies -

This discussion was modified 1 year, 6 months ago by

-

7 Replies

-

Suggestion; I would base it on what information I had already supplied on my other tax forms.

-

Thanks for your reply.

I assume you mean previous tax returns, I have answered the questions on the supplementary form in the same way. I receive a tax statement annually from my investment company and on that statement it specifies the relevant items and their amounts with a tax return code for each item. This code actually refers to the question number for this item appearing on the supplementary tax return form e.g. the code 13C refers to the amount of franked distributions from trusts and has been entered on the supplementary form in Q13C. Hence, for this return and previous ones, I have transcribed those amounts from my investment company’s tax statements onto the supplementary form, as shown in the supplementary form pdf.-

How much time do you have to complete it? If you have time maybe wait until the next q and a comes up? I can’t answer your question, it’s a bit too involved for me, but maybe some one else here will see it and answer it for you.

-

I only have until this Friday, but really need to finish and post it today, or at latest tomorrow so the ATO can get it early next week.

-

Well so long as you have evidence for any declarations you make, then all should be well. Anything in the private such as unregistered trusts is your private information and the tax department have no jurisdiction over that unless you volunteer to give it to them. If you are following what Mark says to do then I would think you will be fine, I know how stressful it can be though when operating in unfamiliar territory. Think relaxing thoughts and have faith it will all turn out for the best and don’t let the tax department or anyone else frighten or bully you. Try and prepare for all eventualities and then hand the results over to Yhwh. Isaiah 41:10

“Fear not, for I am with you; be not dismayed, for I am your God; I

will strengthen you, I will help you, I will uphold you with my

righteous right hand.” Romans 8:31-

Thanks MJ.

I have all my evidence for my declarations, so I am not concerned about that. So all is well.

Yes, with God on our side, we have nothing to fear or lose.

-

-

-

-

-

-

Hi there,

If you are earning income from your investments via an investment company that is likely to file information on your behalf, then you will need to fill out the supplemental form.

If you are managing your own shares and all that, my experience is that they are less likely to audit capital gains. This is the first financial year where I did not disclose my capital gains from share investing, only dividend income. I believe that capital gains from our investments do not classify as income under their definitions. It is a reward of our labour and risk-bearing in other assets.

I was able to get my full tax refund back after a two month turnaround period.

In the past, I did declare my capital gains. I may have made some calculation errors since I make around one hundred trades a year. I would have to apportion my initial cost of my share sales, plus capital gains discount and I don’t think it is possible to do it 100% correctly.

I’ve only ever had the ATO audit my dividend income and make corrections, never on capital gains.

My guess is that the ATO tends to flag the easier items such as work-related expenses, dividend income, etc.

But if you do set up an unregistered trust, then it is legally outside of their jurisdiction. I plan to do that soon.

Hope this helps.

God bless,

Brian