-

Part payment of tax withheld

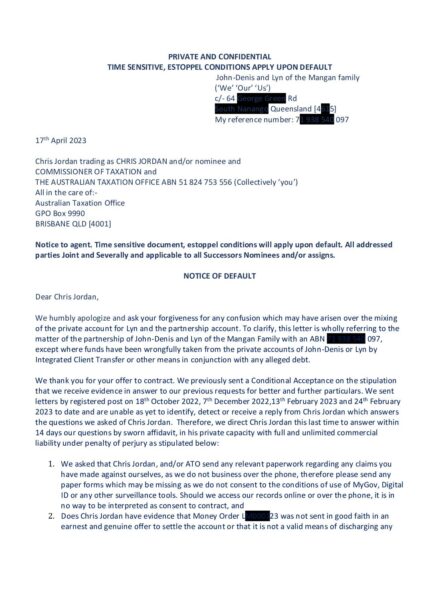

Hi. Feedback please. I filled out tax returns as per instructions for my individual account, and have received full credit for 3 years of late returns, but they debited my individual account for a previous debt from my last return, and a debt held in a partnership for which I sent late returns last week. I received 2 cheques equalling the balance on my client running balance, where they have withheld thousands which they been transferring to a partnership without my knowledge or consent. I sent an adjustment for my last tax return completed by accountants in 2019, but I’m not sure if it’s too late.

I am about to return the cheques with a notice to the effect, “I reluctantly return these cheques to your care until such time as you return them with the full balance of my individual account for TFN …… I received them on the 31st October and have not rejected them, but return them within 72 hours for fear that, you may consider partial payment of full amount owing to satisfy the total debt. Please return them when you pay the remaining $5,896 including fees and funds mistakenly transferred to another account. I have sent further information which may have crossed in the mail. If full payment has since been made, I apologise for any dishonour. Please forgive my misunderstanding and return the cheques in a timely manner.”

Am I creating a dispute where none exists? Or should I wait to see if they refund the rest once they review their papers? I’m mindful of the 72 hrs and don’t want them to assume I am satisfied with partial payment.

Thanks

:Lyn