-

Self-managed super fund

Hi everyone,

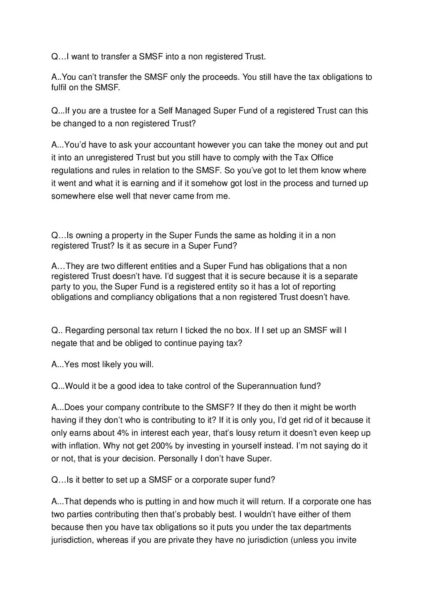

A while ago, we heard about Alex and the peoples lore of terra australis. In one of their videos, they talked about setting up a private trust for your superannuation. The idea is to hold your own superannuation funds in a private trust account instead of a retail super fund.

So far, I couldn’t find any information on the peoples lore of terra australis website or telegram group on how to set it up. After that, I went ahead and searched myself, and all I could find was information regarding self-managed super funds. They are registered and need to comply with the ATO. From what I gathered, it seems pretty hard to move out your money from your retail super fund.

We would like to have more control over our super funds, especially regarding investments. My idea is to open a self-managed super fund trust, but sign all documents like trust deed, bank contract, etc., with ARR signature. Also, I thought since one has to lodge an annual return with the ATO, to fill out the form like shown from ‘Module-2-Legally-Legitimately-Minimise-Tax-Personal-AndOr-Business-Tax’.

I thought I would share my idea with the SE forum and see if any other members have tried something similar, have insights to share, or feedback.

Cheers, Melissa

-

This discussion was modified 1 year, 4 months ago by

Melissa Bockelmann.

Melissa Bockelmann.

-

This discussion was modified 1 year, 4 months ago by