Homepage › Private Community Forums › Minimising Tax › Tax return

-

Tax return

Posted by DOJ on September 15, 2022 at 5:15 pmHi folks wondering if someone can give me some advice or if they’ve had any success with their tax return when completed as per webinar.

I sent the return via registered post with Affidavit attached and after 4 weeks of receipt I’ve received a txt message to request Me to call to provide further information in order to complete the assessment, they gave me 2 days to call.

I’m avoiding the phone discussion and will follow up with another letter via registered post , any help would be greatly appreciated on weather it’s a standard default letter and 2nd notice or another method that should be used.

Pete

yort replied 2 years, 3 months ago 8 Members · 65 Replies -

65 Replies

-

I’m preparing to send mine soon and I’d like to know the answer to your question. On one version of an affidavit, there’s a clause which states all future correspondence is to be in writing, no doubt to avoid any trickery on a phone call. A local JP signed mine without hesitation and seemed more interested in having a conversation

-

I also have a question regarding the affidavit of expenses as I am listed as director of a small non-reporting company (soon to be dissolved). Should it be included on the affidavit that I, the living woman merely ACT in the capacity as director of said company, or just be prepared to make a statement of fact if they ask?

-

You decide which moves you make and when. This is a game of; their move, our move, their move, our move. Sometimes, as in the game of chess, there is more than one move you can make. Each move you make has its own set of potential consequences to deal with. It’s a matter of discerning what you think is the best move to make next.

-

Thank you. I think I’ll leave it as is and cross that bridge when and if I come to it. The affidavit is a statement of I am. I am not a director, no more than a citizen, taxpayer, resident, or any other creature of statute. It is not who I am, rather what I do. In light of that, I have the accountant’s minutes for the company which I haven’t signed or autographed as yet as it has 2 lines, one for Agent and one for Taxpayer. I’m not a Taxpayer though the director possibly is (?). I thought I may autograph on the agent’s line. We will no longer be using the accountant and will send a letter saying so, but there are minutes to lodge for public company compliance

-

-

-

Imangan is right there needs to be a statement such as this “You are compelled and required to deliver to me at the above disclosed address your sworn or affirmed affidavit rebutting each and every paragraph, point for point and with evidence, to this affidavit for your truth to prevail or admit by default by your failure to reply and answer this affidavit to your acknowledgement and agreement to your lack of authority, jurisdiction, status and standing over my family and me, and

We do not consent or authorise to be contacted by telephone, cellphone, text message, e-mail or personal visit about this matter.”

-

Thanks for all the information Imangan

I’ll definitely keep this posted once the out come is achieved,

It’s cat and mouse so far , awaiting for a written response after notification given to ATO that all communication to be in writing.

Thanks again

-

Hi folks just an update on my post which a few of you are following following. Marks step-by-step process as per the webinar and chasing up the ATO today via telephone I had verbal confirmation that the account assessment which has been under review for the past couple of months has been credited with over $18,000, When enquiring regarding what the status is with the ATO representative I was informed the paper method process is normally take up to 70 business working days due to extensive checks required to process them that are lodged manually. Hopefully that doesn’t change as I haven’t received the cheque as yet but according to the ATO rep she did say the account is in credit so I’m hopeful it’s just a case of processing the cheque and sending it, just wondering if anyone can confirm they have had this processed successfully and received the refund? I was fairly greedy in my assessment and decided to go for the whole lot instead of gradually year by year increasing it as per Mark’s instructions.

Outside of this subscribing to Mark‘s solutions empowerment website and his team over the last two years and the minimal fees charged it’s paid massive dividends and I’m encouraging my friends and family to do the same marking

Mark and team if you’re reading this, appreciate everything that you have taught me so far all best ,keep up the great work! hopefully we can all get up to as close as the level of knowledge you have and help others as you are doing and bring this global deception to an end sooner rather than later .

Regards

Pete

-

Excellent news! I’m awaiting a response to my application, but was expecting delays with the manual processing. My husband is waiting to see if it works first too. We both received PAYG instalment forms which I autographed and adjusted to $0. We haven’t received those for ages? I also applied for my source document to the birth certificate. That was 2 months ago too.

-

Update on my own application, today I received full credit for all tax withheld for the last 3 years. Thank you, Mark! Only issue is that there was an amount owing previously, so I will be sending another letter requiring payment to myself and an adjustment for the previous return. Will let you know how that goes. Husband and son are willing to try pending on the result of the next step.

-

Fantastic news I’m glad you had success . That’s great , hopefully my Cheque arrives soon after having verbal confirmation by ATO rep “ My Account is in credit”

-

Hi All,

I’m very new to this process. I have an existing “debt” with the non-legal entity that is the ATO. I know lmangan & has been very helpfull. I need to go through Marks’s webinars.

-

How are you going with it? It’s hard to know where to start. In hindsight, I possibly should have sent an adjustment for existing debt to clear it first, then submit the last few years.

-

There is some great information on this if your budget can stretch to that…http://solutionsempowerment.org/courses/part-1-rules-of-the-game-3-day/

-

-

Hi All just an update with my return , they sent me an audit request to provide receipts for claiming $67000 to bring the tax amount under the $18200 thresh hold in “other work related expenses”. I informed the ATO it was for sustenance of living which they rejected as per my affidavit sent with the tax return . ATO have sent a fine for just under $9000 claiming the “supporting documentation (affidavit) as being Pseudo Lefal and “Constitutional arguments “ and found to be negligently filling out the assessment return form , I’m going to follow up with a jP witnessed notice to the Deputy Commissioner regarding a notice of Direction and instruction.

-

Nice work Peter. Thanks for the share, as it is good to see how others are responding and it helps with us newbies that are learning the ropes.

I am still getting the feel and Im not sure if you can help or someone else might jump in. I was wondering, if it came down to the nitty gritty, no matter what, Our word is our word and we can only serve one master, and even in their court system, ultimately He is above them, then (Wo)Man, so that place has no authority over us?

Cheers Ant

-

Question, is the ATO claiming to be a court? How do they have authority to fine anyone? Does that mean the ATO admits they are not working within the constitution? Would you be willing to take it to court? Would the ATO like this aired in court? Keep us posted.

-

Hi imangan , sorry for the late response, yes I asked the ATO to clarify how they are able to pass judgment and impose “ fines “ in my latest correspondence with them I’m interested to see what they come back with

-

-

Would you mind sharing the ATO letter? Would this be a good time to conditionally accept and start 3 step process so that you remain the creditor and are acting in honour? need morag:)

-

They seem to be making a lot of unsubstantiated claims to my untrained eye

-

Yes probably the best course of action with the 3 step process , it’s my understanding that the ATO is a private trust and you can only take the trustees to court being the commissioner and or deputy commissioner, so when needing to go straight to the source these two are the only ones who can deal with this.

-

Check with morag but I say ATO is not a trust they only exist on paper. They have no jurisdiction nor standing and can only try to get you, the living man to contract.

-

-

-

Did you use Mark’s Affidavit of Expenses? Just a question, wouldn’t claiming been a living man but using a common law birth certificate as evidence bring you under their Jurisdiction as it’s a man made law. But the living man is not subject to man made laws?

-

-

-

-

morag just a question. ATO have made 1 and a half pages of claims, should all these be identified and individually laid out in the response asking for evidence to prove? As ATO have claimed the amount of $9,000 should this be treated separately to the $60k they owe DOJ? as in do separated 3 step processes need to be done for each amount or can it be combined now? turning the $9,000 amount into an amount payable when they can not provide evidence?

-

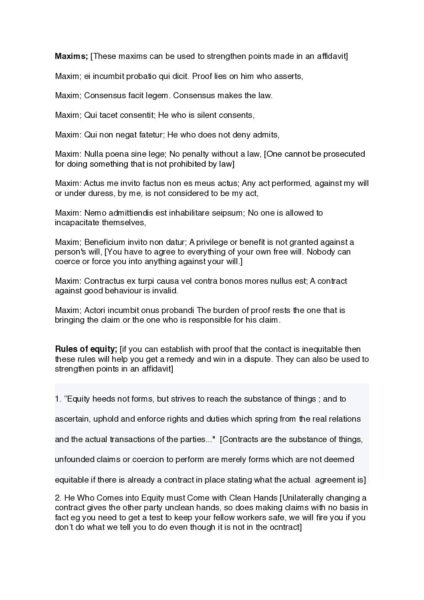

They should definitely be responded to in that way, identifying each claim they have made and asking for evidence for their claim. He who makes the claim bears the burden of proof. I’m not sure whether they should be dealt with separately or not, that will be up to the person dealing with the ATO. They could do either. Here’s a few maxims and rules of equity I sprinkle throughout my Notices to reinforce points I am making, some may be helpful to you

-

Awesome thank you will have a read now.

That $9,000 definitely needs to be turned into a contract should they not be able to substantiate their claims, not able evidence they have standing or evidence they have jurisdiction over the living wo/man. So that they have to pay that amount

Also, regarding their attempt to get DOJ to contact them via a text message (DOJ’s 1st post in this thread) how do we address this when DOJ notified them in the affidavit that communications must take place via written communication? Do you call (and record) and say thank you for your offer and I conditionally accept to provide requested information but via written communication via Australia Post?

-

-

-

Your welcome, I sent of the documentation to the Deputy Commissioner and will keep you updated on the outcomes as they take place ,

There’s also a great resource on bitchute which is almost exactly the same as Marks teachings on the Income tax assessment for individual return questions that can be used The Matrix Decoded

Great resource if your relatively new .

-

In your reply to the commissioner, Did you address every claim they made in the letter they sent?

-

-

-

-

Thank you for your kind offer giving me the opportunity to contact you by text however I reiterate as in my previous correspondence in my first Notice of Non Consent and Conditional Acceptance to you, that only a reply by registered post will be a valid reply and therefore any correspondence from me to you will also be via registered post to ensure we both have a valid commercial record of what is being agreed to by all parties involved. I look forward to receiving your response by registered mail to this address blah blah blah.(or words to that effect, just reiterating what he said in his Notices). Make sure he keeps a record of his reply.

-

ok, sorry for another silly question. Your response would be a written reply, not a phone call?

Also, I was just thinking, they only gave DOJ 2 days to contact them. Would you also question if that time frame is equitable.

-

Yes written and keep a record. If he is unable to reply within the time frame for a valid reason then he needs to start his correspondence with ‘My humblest apologies please forgive me for the late reply but unfortunately I only received your response on blah blah date as I was away when the mail came and I responded as soon as I received it’ or something of that nature. A sincere apology resets the default.

-

Thanks Morag,

Appreciate your tieless efforts in following most of these posts and adding your understanding and knowledge of some of the processes,

The ATO officer actually gave me one week to respond with receipts for my claims and the statement that the ATO feels my claims are pseudo legal and based on constitutional arguments did amuse me , my biggest mistake wasn’t taking marks advice and thinking I’m knowledgeable enough to speak with ATO officer on the phone with setup questions and should’ve stuck to Marks advice and sent another letter to the ATO stating (as previously) that all correspondence needs to be put in writing, I guess in hindsight my confidence (or ego) got the better of me and I thought I could deal with them over the phone with the knowledge that I have through this group but I can honestly say now that I’ve still got a bit more learning to do before I’m anywhere near what Mark is able to achieve in verbal discussions and insuring i’m well prepared at holding my position setting up the opponent to lose and not make any mistakes when dealing with them verbally.

Be well .

Regards,

Pete Doj

-

Mate any news? That’s a big claim regarding the pseudo science. Even if I didn’t know Mark’s process I would be asking them to provide evidence for that claim and not let them proceed until they evidence the claim.

-

Hey mate yes totally agree with your post and waiting for the proof of claim from the ATO which they failed to respond to.

I’ve given the deputy commissioner a default notice now and one more to go if a full rebuttal of affidavit is not supplied by her. Do you have to fight fire with fire sometimes and they point trying to go after a fictional organisation such as the ATO better off going to the straight to the head of the snake or at least the deputy in this case the deputy commissioner as a living woman who needs to answer and provide proof of claim which I’m sure she can’t but it’s gonna be a fun process either way.

I’m still learning how the system works so you can use it against them as everything they’re doing is fraudulent either way when I deal with a fictional entity or a creature of statue as we are known being taxpayers.

I’ll keep you posted.

Pete

-

Ok mate I’m just trying to work out what you have done. Did you list all the claims in the letter they sent you with the fine and send a conditional acceptance? Or by affidavit are you saying you sent the above affidavit as it is in the photo?

-

This reply was modified 2 years, 6 months ago by

yort.

yort.

-

This reply was modified 2 years, 6 months ago by

-

-

-

-

-

-

Hi Pete good on you, it’s a learning curve for all of us and I must admit I have done things when interacting with the authorities that I had trained myself not to do, when we are under pressure unexpected things happen. That is the best place to learn though, on the coal face as it were. We learn far more from our mistakes than our successes for sure.

-

Hi Morag.

Sorry for the late reply, yes sometimes mistakes are a blessing in disguise as you learn what not to do I’m still battling with the ATO do to speak as they won’t rebut any of my claims or affidavit .

I’ve just sent them the default notice and one more to go before we’re in agreement there is no fine or debt and also ring numeration for full tax credits held by the fiction name.

Be will I’ll keep you posted.

Regards

Pete

-

-

Just wondering if anyone here has filled out a company return before? I have severed ties with our accountant, but I’ve never completed a Company return before, or submitted minutes to ASIC. If anyone has any advice, that would be appreciated. I’ve also seen comments that ATO has emailed agents from 13th December, accountants will no longer engage business clients or submit returns without the digital ID. Good excuse to stop playing the game?

-

-

Hey guys,

Thanks for sharing all of this great info. I put together a fairly solid tax return package with strong Affidavit and Certificate of Mailing documents attached, I sent the documents away via registered post 1st Oct 2022, I have still not received a reply of any sort almost 4 months later. I have checked the myGov website and they have received my tax return package as my 2021-2022 return displays “in progress” and “under review”. As I stated that my withheld tax credits need to be returned to me within 14 days of receiving my tax return, should I now be following up with a default notice as they have taken to long to settle the matter or wait for a reply from them?

I have had a busy couple of months and did not see the date that my details were recorded on the myGov website so it could still be within the “70 days” processing time mentioned before.

Thanks for any suggestions in advance

-

Hi all,

I filed the tax return online 2020 and received back all of the tax paid $27 808.96.

The following year I attempted the same process. This time I received correspondence on the 21<sup>st</sup> January 2022 that requested “more information about your 2020 and 2021 tax returns”. I copied the letter titled ‘more information about your 2020 and 2021 tax returns” and sent it back along with an affidavit of expense and declaration in the form of an affidavit via registered post.

The next correspondence I received dated 9<sup>th</sup> March 2022 was “We have finished our audit on your 2020- and 2021-income tax returns”. They applied an administrative penalty to the 2020- and 2021-income years due to my being “reckless”. For 2020 they applied an administrative penalty of $13 904.45 plus the amount they gave me back $27 808.96 and 2021 $13 215.70 – totalling about 56K.

I immediately sent 4 notices to the woman who was the officer on my audit dated 20<sup>th</sup> April 2022, 27 April 2022, 4<sup>th</sup> May 2022 and 11<sup>th</sup> May 2022.

I received a phone message 16<sup>th</sup> May 2022 from a Kirsty C wanting to “discuss my tax obligations”

The next day on the 17/05/2022 In response to the message left I sent a notice of conditional acceptance and no consent re: subject matter jurisdiction. I also sent 2 further Notices on the 27<sup>th</sup> May 2022 and 03/06/2022. The 3<sup>rd</sup> Notice had an invoice (first invoice) for the amount of $27 860.54.

I received no response or correspondence to any of the above notices.

In the meantime, I was not aware that they already just went right ahead and issued a statement on the 15 March 2022 in Mygov for the total amount of $56 051.89. This included the amount I got back plus the 2 lots of 13K in penalties for being “reckless”

So, I printed the Mygov statement and on the 15<sup>th</sup> June 2022 did an A4V on the statement with a Notice of tender of payment via registered post. The tax office responded by leaving messages on my mobile despite me advising that they need to contact me only by the address provided.

So I sent a further 2 Notices to the man and woman that left the messages to follow up with the first three I sent – A Notice of demand for further and better particulars and opportunity to cure with 2<sup>nd</sup> invoice and a notice of demand for further and better particulars and notice of default opportunity to cure with a final invoice.

I have not logged on to MYgov for a number of months, in fact I want to remove it but it’s handy to see what they are up to. Last time I looked they added more fees for the alleged non-payment of 56K– even though I did an A4V.

That’s where I was up to last year in about June. To be honest I have left this on the back burner until now as I was dealing with the Toyota matter. They have still not responded to any of the correspondence that I sent.

Now the ATO has changed tactics – So now, Jan 2023 I received correspondence “we noticed you have not done your tax return” …… and just today I think I just received another one the same in the mail – I have not opened yet as I am not sure how I want to proceed.

I thought I’d give you all this run down so that you might have an idea of what to expect and the way they have taken to dealing with us.

Kate

-

When the tax dept sent me unwanted correspondence I said the matter had been dealt with and I would be sending them an invoice for $1,000 for each piece of correspondence that they required me to answer from this time forward. They stopped harrassing me.

-

I went through a similar process as you Kate but I haven’t heard back from them after doing similar to Morag after the 3rd unrebuted notice I sent the “ Living woman known as Hoa Woods” (deputy Tax commissioner) a summary of fees stating any letter sent a $10000 fee will be applicable per page sent for me to read and $10000 per page I send back in correspondence . As per their usual tactics they ignored the notice and sent a reminder . I’m just getting myself knowledgeable on serving “commercial Lien “ processes to claim payment , if you read the letter you will eventually receive regarding your “Penalty “ Ant see attachment and circled comment by ATO .

Firstly the ATO is not a court nor have you been found guilty by your peers for the ATO to have authority to apply a fine or penalty so ask how they are lawfully able to provide judgement and apply a “Penalty” you should also copyright your all caps straw man names ( go through all bank statements , drivers license , rates notices etc to capture every different way they refer to your straw man and list them all through the “The Peoples court of Terra Australis” website (its free ) you can also create a document of live birth and a series of other documents .Have fun as it’s all just a game of cat and mouse , you just have to make sure you put your self in the cats position and serve all the notices ,affidavits etc and once unrebutted by the ATO they are as Mark says IN DEFAULT AGREEMENT . Good luck Ant

-

Cheers Peter, that is Gold. Happy Terra Australis Days, all 364 and quarter of them. Looks like you are having good time with it all. From The Land, Not The Sea.

Thanks for the share.

-

-

-

Yeah, a dad joke with a bit of Old Spice. Do you know the letter?

-

(In my best Pirate voice) You think it’s the R, but it’s actually the C.

-

That joke makes more sense to me now, more than ever. The World is definitely run by Pirates who love the Law of the Sea.

-

-

-

-

-

Hi Kate and all,

Just an fyi

You should get rid of the myGov account or your still agreeing to contract with them , plus that also forces them to only be able to send you letters and give you time to send your response if you want to deal with them .

I normally mark any letter received with a red pen ,

“ Deceased Estate “

“Return to sender , no contract , no consent , cease and desist “. In red pen and a date it .

Take a photo for evidence and send it straight back .

You can google search the P.O. Box number printed on the letter if your not sure who it’s from . I stopped paying tolls , and all sorts of “Tax invoices / statements “ via affidavit processes and any further letters correspondence they send the letters just get sent straight back as above and eventually they give up .

-

-

Hey everyone,

I have received a request to “give us more information about your 2022 return”. The ATO have asked for “supporting documents” that I used to work out around $80,000 of other work related expenses. Receipts to cover that figure are not an option. I dropped my total “Income” figure to $75.

Has anybody tried to send back a receipt from the living (wo)man sent via postal (portal) service to the legal fiction for a total of (in my case) $75, for the use/hire of the legal fiction name/entity to conduct commercial transactions in the public realm, or something to that affect? I feel this is not mixing jurisdictions as warned not to do as it would be 1 simple and effective receipt, received by the legal fiction to evidence the legal fiction’s true income. Any thoughts?

Also, at this point in the battle, after seeing a few people send away their additional information only to receive a response of fines for being reckless, would it be worth including some preemptive information in my response, something along the lines of;

Without Prejudice

The legal fiction, “<NAME>” will not be accepting and DOES NOT CONSENT to receiving any fines, penalties, requests of theft of private property or any other offers, agreements, contracts where the living man answering to the name “<Name>” OR the legal fiction “<NAME>” is requested to enter into any new business opportunities with AND/OR pay any additional currency /money /credits to the ATO (Australian Taxation Office) or any agent working for the ATO (Australian Taxation Office) or any related debt collecting agencies regarding this matter.

To the best of my knowledge, this issue has and is being expressed as true and accurately correct as possible and any penalty would be far from fair OR equitable as any court would uphold.

Thanks in advance, Scott

-

cool idea bro. Shouldn’t all that already be covered in the affidavit you sent them? Sorry, I don’t really understand your reasoning as to why you would send that receipt either.

How many battles you got going on? Are you keen to do what’s necessary to get your money back from them

-

Yes, my affidavit did include all the information that the full productivity of my labour was used to sustain the living man as to allow the living man to carry out work, etc. I’m just considering the fact that “he who makes claims, bears the burden of proof”. I’m sure that they are not easily accepting an affidavit alone as enough “proof” for them. I have made claims on my tax return regarding my “other work related expenses, now the ATO have requested me to provide “supporting documents” to support my claim. I’m thinking that the receipt for use of “legal fiction name” is a form of proof / evidence “used to work out my claim” vs supplying nothing at all and may be harder for them to deny or reject.

This is my only battle currently and my main focus, I went for 100% of MY property and am ready to immerse myself into the full experience of retrieving my private property from the sly criminals.

-

Keep at them Scott. Go for the individuals that come after you and put them on Notice. Play the game and catch them out. You are a Man before any Name or Title, and that is superior in the The Hierarchy of Authority. No Contract to say (i) property. No Authority over you.

Good luck with it all and keep us posted on your travels.

Ant.

-

Love ya attitude mate. I want to do what you have done but I have too many battles at the moment.

For them not to accept the affidavit they would have to your affidavit point by point and provide evidence to support their claims wouldn’t they. I’m just thinking of the top of my head here but I would thank them and notice them that they have answered a question but it’s not an answer to any of your questions. Did you give them 28 days to rebutt your affidavit point by point?

-

-

-

Your affidavit is the receipt is it not? Could you conditionally accept there offer using the condition that they rebutt your affidavit point for point?

-

-

We received a fine for overdue lodgements that I sent last year, but the Registered Letter was never collected or returned. I also notified them 3 times, I cannot use mygov, so if they need me to fill out forms, they must send hard copies. As to the fines, I sent a conditional acceptance based upon evidence that they are a court with authority to impose fines according to the high court and not a (private?) Corporation. I’m waiting for a response.