-

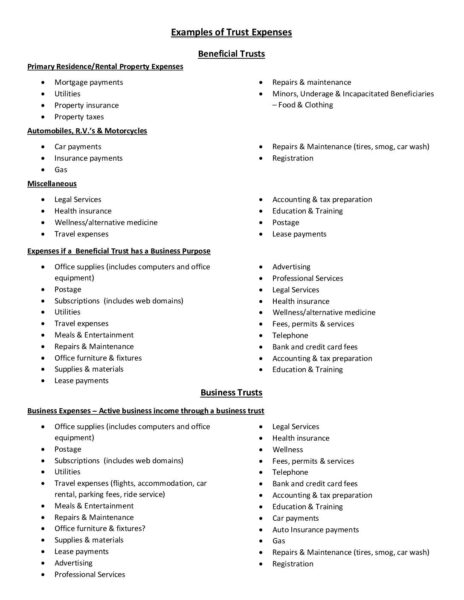

trust expenses

(1) Just trying to get clarification on what constitutes trust expenses….i have attached a pdf i found somewhere….any confirmation that these are legit expenses applying to one of marks trusts…or does anyone have a schedule of trust expenses that they use or can recommend?

(2) also, just for clarification..in trust deed, it says trustee should keep proper accounting records etc in order that it could be conveniently and properly audited.. and at end of accounting year, trustee should prepare a balance sheet. However, it then says that there is no obligation to appoint any auditor……heres how i comprehend that….

It is the Trustees role to keep correct accounting records and to act with integrity to uphold and grow the trust fund and make appropriate distributions…the accounting records are for his/her and the beneficiaries information ONLY so that all parties within the trust are clear about the trusts activities. As regards accounting and disclosure to beneficieries, the Trustee can choose what works best for him/her i.e. whether to keep monthly/quarterly/ bi annual minutes and No external body/person/corporation/entity has a right to know the trusts private business. ….as long as there is no criminal activity ofcourse!…does that sound right?

(3) think I have already asked this…but expenses can be used against any so called CGT.

Final point…are there any videos/webinars on simple trust accounting methods? Or would anyone be happy to offer simple accounting strategies that they use/work for them?

Just trying to keep it simple as poss and paperwork to a minimum but with a clear comprehension of it all. Thanks for any tips.