-

Wise and Trust

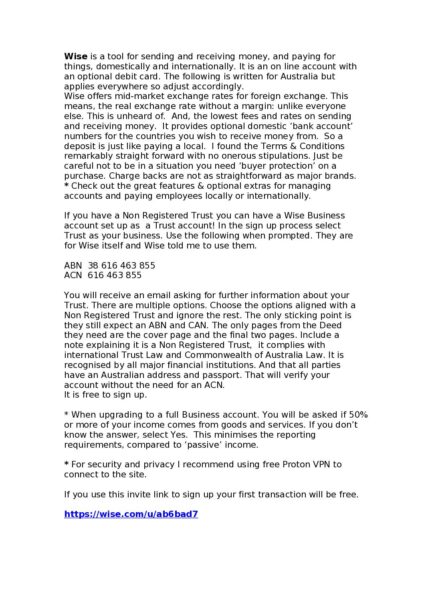

‘Wise’ is a global online financial service for sending and receiving money and buying things. With debit card optional. Available in all countries. It offers mid-market rates (no margin) for foreign exchange – unheard of in the consumer market! And the lowest rates and fees, really very minimal. It can also be used as a Trust account, for Non Registered Trust owners. It is free to use for personal use but an upgrade for full business features is a one-off AUD$22. I have put together the specifics on how to benefit from it and how to have Wise accept your Trust account, in the attached document. Whether or not you have a Trust its a useful facility. I have studied the T & C and found nothing onerous or unusual, in fact it was streamlined compared to other financial services providers. I can see use for it acting as a firewall to the Public.