Foundational Knowledge (Course Group)

Public Course Group

Public Course Group

Active a day ago

To join this group, please first commence the ”Foundational Knowledge” course, which includes access... View more

Public Course Group

Group Description

To join this group, please first commence the “Foundational Knowledge” course, which includes access to this group.

Credit Card

-

Credit Card

Posted by honestum on March 28, 2025 at 8:37 pmMark, mentions a strategy whereby you can obtain a credit card and then use that value to pay down a mortgage and then pay off the credit card with a promissory note.

How can money be transferred from a credit card to a mortgage, my mortgage does not allow BPAY or other payment methods except directly from a bank account linked to the mortgage.

Any ideas?

honestum replied 6 months, 1 week ago 7 Members · 12 Replies -

12 Replies

-

Get a credit card from a different bank. Do a cash advance from the credit card account. Deposit the cash into the mortgage account. Viola!

-

You can take cash off a credit card and pay it into your bank for your mortgage.

You could also pay for everything else with a credit card and use the money you saved to pay your mortgage. Then clear the credit card with a financial instrument like a Promisory Note. It works out the same. You end up with the money off the card and your mortgage paid.

Also, make sure you are ABSOLUTELY CLEAR, PRACTICED & SKILLED with promisory notes and/or Bills of Exchange, and more importantly, the process of holding your ground if you get pushback, or you will just lose and end up in debt!…

You really need to watch as many, if not all of, Mark’s different course videos to get a real feel for what it is all about, before you try this stuff. It all sounds easy when Mark talks about it, because he has half a lifetime of experience, both good and bad, and this stuff is more complex than assuming you can just use it. Don’t be scared, but you must be prepared! It’s all possible, but only to those that are well prepared.

Start with small stuff and build yourself up.

Not preaching, just learned myself from some hard callenges and dissapointments, as well as some enjoyable successes. Getting better, but it is a learning curve for sure. If you are just being greedy and are too lazy to really learn what you REALLY need to do, you will lose and get yourself in the shit with a system that is designed to eat you up at every turn. Mark has said pretty much all of this in his instructions so make sure you learn as much as you can from him, and not just the little bits you are trying to get a gain from. It’s a system about how to approachthese things what to do, it’s not a lazy way to get rich scheme…

All just my opinion. Take it as you will.

-

Excellent observations, Thanks for sharing your invaluable experience, I’m sure everyone here will benefit from it.

-

-

Thank you to all for your replies. I’m learning lots I just spent the best part of today reading the Income Tax Assessment Act, Currency Act and a few other side diversions as I follow the rabbit hole that is our colour of law legislation.

-

Hi Fellow SE Members,

I have been reviewing the Promissory Note module multiple times and the downloadable documents.

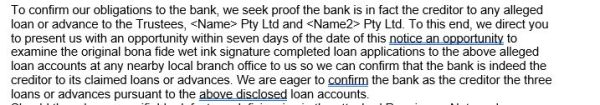

My question relates to the Notice of Payment Letter to the financial institution.

Within the template, it is worded for discharging a mortgage an I am seeking to use it for discharging a credit card.

This is what it currently states in the attached image. In my situation for a credit card or even a personal loan I feel I need to delete this section as it would not be relevant.

The instruction document from the download pack is silent on this matter, thank you for your thoughts.

-

You can edit the relevant documents in any way you need to for your matter as they are to be used as templates not set in iron wording. They are your documents to write or edit as you see fit. Once you have signed them you are responsible for what is in them. If you understand exactly what they are saying by ensuring you have completed extended study by way of listening to the relevant webinars and are prepared to hold your position with them, then you are ready to send them.

-

-

A small update and a question for the Community.

I have moved forward and completed the Acceptance for Value process on a Credit Card Statement to Pay back in April, they have kept the payment. As of the end of July the three demand notice process has been completed and the credit card company still has not answered any of the notices or returned payment. So now I am sending back their letters with the RTS Paid, for Cause without dishonor wording. and hold my position.

My question is, has anyone else made it to this point and what happens next?

and what module should I be reviewing to be ready for whats next?

Thank you

-

https://solutionsempowerment.org/p/module-9-how-to-hold-your-position/

solutionsempowerment.org

Access Restricted (Not an Active Member) – SolutionsEmpowerment.org

Access Restricted (Not an Active Member) – SolutionsEmpowerment.org

-

Thank you Morag and from tonight’s Q&A Mark mentioned “Dealing with Summons” may be a good one too.

-

-