Foundational Knowledge (Course Group)

Public Course Group

Public Course Group

Active 22 hours ago

To join this group, please first commence the ”Foundational Knowledge” course, which includes access... View more

Public Course Group

Group Description

To join this group, please first commence the “Foundational Knowledge” course, which includes access to this group.

DIscharging Personal Loan and timing

-

DIscharging Personal Loan and timing

Posted by honestum on March 16, 2025 at 10:28 pmHi forum members, and thank you in advance for any input.

We have just recently accepted a personal loan and i am wondering how many months need to pass before we could discharge the loan with the payment options presented in the 10 payment options module which i am studying atm?

Second question what are you experiences with discharging personal loans and which method was most effective?

Thanks

morag-janet-of-the-hill-family replied 11 months ago 5 Members · 23 Replies -

23 Replies

-

You can discharge the loan from day one. No point making a few payments when you don’t need to.

I am getting a personal loan to pay out a car loan that I will use a promissory note for.

I have used the 10% method for the wife’s car loan. She had been paying $70 a fortnight for years. They would have made a lot more out of this loan than they had lent her in the first place. The loan was more than the car was now worth. We took all the money out of her account when she received her payments so they couldn’t take out the loan payments. After she had missed 3 payments they rang and we told them she was seeking financial advice and we would be in touch soon. She owed $5450 we sent them a bank cheque for $550 along with a balance sheet for incoming and outgoing money. (See attached) When we checked her online account they had deducted the $550 from the balance, a week later it said pending finalization, a week after that we received a letter saying congratulations you have payed out your loan.

-

This reply was modified 11 months, 1 week ago by

chris.

chris.

-

That’s amazing, well done!!! Could we see a copy of the balance sheet you provided?

-

Sorry Marag, cant find the balance sheet but if was pretty basic. Rent, phone, electricity, food and the like vs single parenting payment

-

-

This reply was modified 11 months, 1 week ago by

-

Hey Chris,thank you for sharing, it is such an encouragement to hear of your win.

I wonder if they would ever call on us to make good the promissory notes we write and issue? I am still learning and my understanding of promissory notes is the drawer (us) will have to make payment if its called up by the drawee in the future? Or have I got it wrong.

-

“I wonder if they would ever call on us to make good the promissory notes we write and issue?”

My understanding is that a promise to pay is only payable with gold or silver, and in a bankrupt world operating on negotiable instruments exclusively, the only other way to “pay” a promise to pay is with more promises to pay.

I think the general idea is that you promise to pay one day when gold and silver coins return to the payment system. Until then…

-

-

Hi Saul-James, interesting. So take what we save now by using the promissory note and buy some silver while its low, store it a way in the event they ever come to collect….

I was listening to the Promisory video training and Mark mentions a Gold Stamp he uses on his pNotes. Does anyone know where to buy or get one of these from?

Also I was wondering, could the lender ever consider fraud charge against me for the perception on the timing, could they put forward an allegation that I obtained the loan with the foreknowledge of then paying it out with a PN thereby not having an intention to not pay it from the begining( which is not true) but..?

-

“So take what we save now … and buy some silver while its low, store it a way in the event they ever come to collect…”

No. In the bankrupt world we live in that would be like having to “pay” twice. Your promissory note when indorsed and delivered is a cash equivalent. The bank can securitise the instrument and “get paid”.

That’s how they got the funds in the first place. When you blank indorsed the loan agreement you created a promissory note as you handed it back to them (delivered it). The whole world operates on “promises to pay” and “orders to pay” (negotiable instruments).

To get the full picture, read and study the Bills of Exchange Act 1909.

“…Mark mentions a Gold Stamp he uses on his pNotes.”

It’s purely for appearances. The thing of value on a PN is the indorsement (the signature).

“…could the lender ever consider fraud charge against me…”

Maybe they could, but couldn’t you do the same to them? Has the bank been honest about how they acquired

the funds? Did they fail to disclose

something to you? Has not the bank

engaged in fraudulent behaviour? -

Promissory Note artwork, does anyone have this in (pdf. ai. eps.) format as the printer company says the scan in the module is not good enough for printing. Will be paying $250 for 1000 stickers if anyone want any. I really cant see me needing 1000

-

-

Thank again to all who have responded and thank Saul-james, this has been a quite beneficial conversation.

I will continue on the learning journey and lodge the PN and keep this area updated on the progress.

If others have personal loan stories i would value hearing how your experience was and outcomes.

And i am sure i will be back with another question 🙂

-

There’s a Q and A on tonight where you can ask mark any question… https://solutionsempowerment.org/event/general-qa-march-19/

solutionsempowerment.org

General Q&A: March 19 – SolutionsEmpowerment.org

General Q&A: March 19 – SolutionsEmpowerment.org

-

-

Thank you morag-janet i will join the call.

I came across these two failed attempts of using promisory notes in Australia, does Mark address the reasons why they failed in their attempt in any training or other areas of this platform? It would be great to see if the learnings from these cases have been applied to the current version of process?

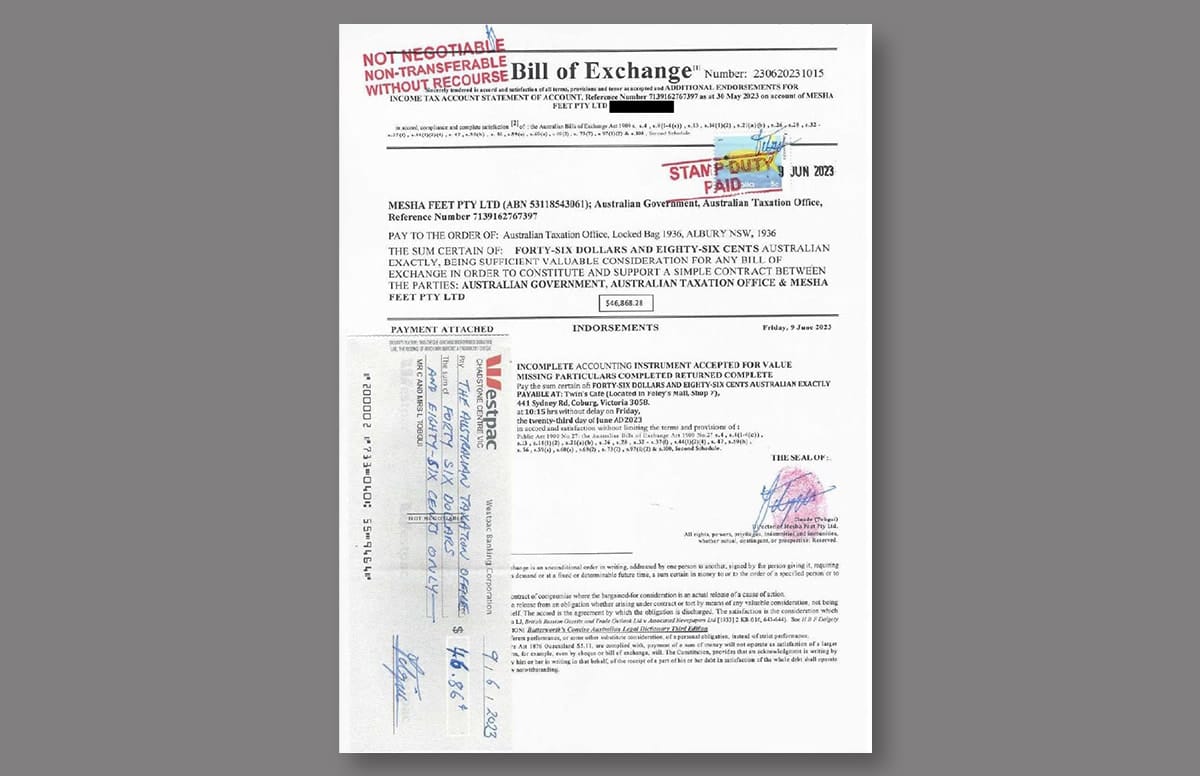

Mesha Feet vs ATO – https://www.accountantsdaily.com.au/tax-compliance/20105-court-rejects-taxpayer-s-attempt-to-pay-45k-ato-debt-with-47-cheque

Bayly v Westpac Banking Corporation, Queensland

https://www.gadens.com/legal-insights/queensland-court-of-appeal-rejects-iou-as-payment-for-debt/

accountantsdaily.com.au

Court rejects taxpayer’s attempt to pay $45k ATO debt with $47 cheque

Mesha Feet attempted to pay its debts with unconventional methods and then fined the Tax Office for failing to respond.

-

“I came across these two failed attempts of using promissory notes in Australia, does Mark address the reasons why they failed in their attempt in any training or other areas of this platform?”

It’s quite possible he does refer to one or both of these cases somewhere among the Q&A sessions, but I cannot confirm that. Alternatively, perhaps we can figure out why they failed?

From what I can tell from reading the articles provided, it seems both failed because they presented testimony/argument/made claims. As Mark constantly reminds us, we must NEVER make claims in any situation, whether in court or along the roadside. Always ask questions.

For example…

“Payment by those means is not a means of payment approved by the Commissioner,” she said.

“The fact that there is no legislation specifying that promissory notes and bills of exchange cannot be used as means to pay tax debts is beside the point. The point is that they are not means of payment that have been approved.”

Q: So we are in agreement that a bill of exchange is a lawful means of payment? And additionally, are you claiming that the Commissioner can ignore the laws of the Commonwealth as it pertains to payments within the Commonwealth?

In regards to the ATO case, the case may also fail because the instrument titled “Bill of Exchange” in the picture from the article is not a BoE according to the Bills of Exchange Act 1909. The instrument in question fails to qualify due to a single indorsement. Where is the ATO’s signature? The only BoE in the image is the cheque itself.

The BoE in reality is the penalty notice sent to you by the ATO; the instrument of first issue, made by and indorsed by the ATO with their seal. The receiver of the instrument may either pay or PAY TO THE ORDER OF. You have two options; you either pay the money or you can indorse it payable to some party.

Bill of exchange defined

A bill of exchange is an unconditional order in writing, addressed by one person (the ATO) to another (You), signed by the person giving it (the seal of the ATO), requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time (due date), a sum certain in money to or TO THE ORDER OF (2nd option) a specified person, or to bearer.

— Bills of Exchange Act 1909 Section 8(1)So, from my understanding the instruments offered to the ATO don’t make much sense if presented alone. However, if those same instruments where presented in the form of a contract renegotiation, as Mark does, that is a different story altogether. When presented as a renegotiation of contract the focus is no longer on the actual instruments but on the contract itself.

It may be a fact that issuing promissory notes and indorsing bills of exchange is an option under statute, but it may also be a fact that the average Joe is unable to use these methods without resistance because we don’t have the Power of Attorney over our legal person. This is probably why Mark uses contracts to discharge liabilities rather than relying on the negotiable instruments alone.

It appears from the articles that both parties did not follow Mark’s methods of operating entirely within contract law and asking set-up questions.

-

This reply was modified 11 months, 1 week ago by

saul-james.

saul-james.

-

This reply was modified 11 months, 1 week ago by

-

-

There are several issues in these cases, not least that they both let the matter proceed too far. It sounds like they must have provided joinder so they were both playing under the court’s jurisdiction. Also, there seems to be a matter of inequitable status of the parties, unless the first is a business to business case, which is a separate matter again. The first matter, the magistrate sounds like they were practicing from the bench? There was a failure to rebut the magistrate or lawyer’s claim that ‘that form of payment was not acceptable’ is an admission that it is indeed a form of payment, whether they agree to it or not. Would it not have been preferable to deal with this by notice before it got to court? These are the sort of cases the public highlight to illustrate and warn the plebs from trying this tactic because they claim it doesn’t work.

-

I was listening to Marks 3 day Melbourne Workshop and someone in the audience asked a question but due to the quality of the recording the answer was muffled.

The question is the same one I had yesterday while pondering this information.

The question was: We issue a promissory note and set the meeting at a the reasonable timeframe then attend the location. If the drawee (the one we sent the PN to, if I have the terminology right), shows up and requests payment on the PN, should we have the currency ready to pay their request or what should we do ( setting aside the other feedback that, to date, none have ever showed up). For example my personal liability may be $30K and I issue the PN for $35K, I likely wont have $35K sitting around to pay the PN if they show up. What do I do? Thanks

-

This reply was modified 11 months, 1 week ago by

honestum.

honestum.

-

If they turned up for payment in gold wouldn’t that then set a precedent and allow us to turn up at the bank for gold as well? Would they be likely to want to set that kind of precedent? Is there any record anywhere of them turning up for payment in gold? Isn’t the opportunity you give them just a process to establish there is no liability against the drawer (you)?

-

Do you realise that the $50 note you withdraw from the ATM is a promissory note?

Does it make any sense to pay a promissory note with a promissory note?

Is it possible to withdraw a $50 promissory note from the ATM and then go into the bank and redeem it for gold?

-

How can the drawee turns up to collect $35K when the legislation limits a business from accepting no more than $10K in cash.

-

This reply was modified 11 months ago by

chris.

chris.

-

They would be turning up to collect the gold and silver. Are gold and silver defined as cash under legislation? Or alternatively is cash defined as gold and silver under legislation?

-

This reply was modified 11 months ago by

-

This reply was modified 11 months, 1 week ago by

-

Wow, ok, there is something im missing here, is there something in the constitution or BOE act that states debt can only be repaid in gold or silver?

And please know i appreciate your energies and paitence in answering my questions, i hope to be where you all are soon and able to help others with their questions. 🙂

-

From the Constitution…

Section 115 – A State shall not coin money, nor make anything but gold and

silver coin a legal tender in payment of debts.https://www7.austlii.edu.au/cgi-bin/viewdoc/au/legis/cth/consol_act/coaca430/s115.html

Now that negotiable instruments are the only form of payment all that you can do is discharge a debt. Actual payment of debts is impossible. That’s why you don’t technically own anything.

Just a suggestion, but make sure you understand as much as possible before you take action with negotiable instruments (PN’s & BoE’s).

www7.austlii.edu.au

COMMONWEALTH OF AUSTRALIA CONSTITUTION ACT - SECT 115 States not to coin money.

Australasian Legal Information Institute (AustLII) - Hosted by University of Technology Sydney Faculty of Law

-