Living-Ascension

Forum Replies Created

-

Hey Team,

I’ve just attempted twice with 2 x separate Bendigo Banks here in Western Australia, both being rejected. First attempt was rejected because they claimed that my trust needed to be redrafted and would not be accepted in that format, the bank would not tell me specifically what was the exact issue with it even after I reminded them that the trust had been carefully drafted to comply with Australian tax laws. Second attempt at a different branch was rejected as my trust was “outside of the bank’s risk appetite”. Going to give Great Southern a go as trying to avoid the big 4. Any other suggestions if my next round fails?

-

Living-Ascension

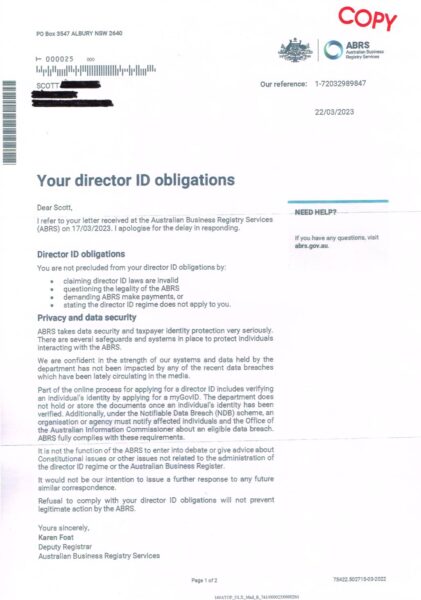

MemberApril 14, 2023 at 3:02 pm in reply to: Email reply from ASIC in regards to Diretors IDI’ve replied with my 3rd edited notice as below to complete my 3 notice agreement (respondents changed for ABRS letter);

Dear Joseph Longo and Jennifer Dolphin,

I thank you and acknowledge your reply letter dated 05 April 2023. It has come to my attention that ASIC failed or refused to respond to my previous demand notices titled “Notice of Conditional Acceptance, Notice and Demand for Further and Better Particulars and Notice of Liability” dated 09<sup>th</sup> March 2023 and “Default Notice, Notice and Demand for Further and Better Particulars and Notice of Liability” dated 27<sup>th</sup> March 2023. Your failure to answer my questions is now taken as your notice of non response.

In the event of some impossibility to answer my questions, a simple oversight or other legitimate reason for not answering my questions, I afford you this third and final opportunity to respond to and answer this, my Third Demand Notice, in order to correct your commercial defaults and your dishonors in having failed to positively respond to my earlier written correspondences. If you fail to answer my questions for this third and final time, you will remain in commercial default, a default private judgement will be made and this document will be kept as evidence of our agreement for any future dealings.

You are kindly and respectfully directed to deliver to me within fourteen days of the date upon this Final Notice, Notice and Demand For Further and Better Particulars, Else Notice of Default Judgment (Third Demand Notice) your answers, with supporting evidence, to the statements within the following paragraphs prior to me supplying you any information pertaining to the Director’s ID, under some real, imagined, alleged or future legislation, Orders and/or directions compelling the Director to supply aforesaid Director ID information;

-

Living-Ascension

MemberApril 6, 2023 at 11:15 am in reply to: Email reply from ASIC in regards to Diretors IDHey guys,

Thanks for all the info so, I have attached a copy of the reply documents from ASIC and ABRS for others to see. I received these replies after I sent the first x2 notices away. I think I may just add some details to my 3rd notice, along the lines of, “Thank you for your reply, however you have failed to answer any of my questions and provide proof of claim so for the 3rd time…….”

-

Hey everyone,

I have received a request to “give us more information about your 2022 return”. The ATO have asked for “supporting documents” that I used to work out around $80,000 of other work related expenses. Receipts to cover that figure are not an option. I dropped my total “Income” figure to $75.

Has anybody tried to send back a receipt from the living (wo)man sent via postal (portal) service to the legal fiction for a total of (in my case) $75, for the use/hire of the legal fiction name/entity to conduct commercial transactions in the public realm, or something to that affect? I feel this is not mixing jurisdictions as warned not to do as it would be 1 simple and effective receipt, received by the legal fiction to evidence the legal fiction’s true income. Any thoughts?

Also, at this point in the battle, after seeing a few people send away their additional information only to receive a response of fines for being reckless, would it be worth including some preemptive information in my response, something along the lines of;

Without Prejudice

The legal fiction, “<NAME>” will not be accepting and DOES NOT CONSENT to receiving any fines, penalties, requests of theft of private property or any other offers, agreements, contracts where the living man answering to the name “<Name>” OR the legal fiction “<NAME>” is requested to enter into any new business opportunities with AND/OR pay any additional currency /money /credits to the ATO (Australian Taxation Office) or any agent working for the ATO (Australian Taxation Office) or any related debt collecting agencies regarding this matter.

To the best of my knowledge, this issue has and is being expressed as true and accurately correct as possible and any penalty would be far from fair OR equitable as any court would uphold.

Thanks in advance, Scott

-

Hey guys,

Thanks for sharing all of this great info. I put together a fairly solid tax return package with strong Affidavit and Certificate of Mailing documents attached, I sent the documents away via registered post 1st Oct 2022, I have still not received a reply of any sort almost 4 months later. I have checked the myGov website and they have received my tax return package as my 2021-2022 return displays “in progress” and “under review”. As I stated that my withheld tax credits need to be returned to me within 14 days of receiving my tax return, should I now be following up with a default notice as they have taken to long to settle the matter or wait for a reply from them?

I have had a busy couple of months and did not see the date that my details were recorded on the myGov website so it could still be within the “70 days” processing time mentioned before.

Thanks for any suggestions in advance

-

Living-Ascension

MemberApril 11, 2023 at 4:53 pm in reply to: Email reply from ASIC in regards to Diretors IDThanks very much morag. Last Q&A, my questions were not getting through to mark and I could not read the chat, hopefully works tomorrow.

I’m thinking that I should just send away my 3rd directors I.D. notice as per SE templates to complete the 3 notice process regardless of ASIC claiming no responsibility rather than change the details aiming more towards ABRS at this point. What are your thoughts? I will try to get more clarity and guidance on the Q&A tomorrow.

-

Living-Ascension

MemberApril 11, 2023 at 1:08 pm in reply to: Email reply from ASIC in regards to Diretors IDNo I hadn’t seen this, thanks very much. Has mark done any recent webinars or Q&A sessions on the Directors ID subject matter at all?

-

Yes, my affidavit did include all the information that the full productivity of my labour was used to sustain the living man as to allow the living man to carry out work, etc. I’m just considering the fact that “he who makes claims, bears the burden of proof”. I’m sure that they are not easily accepting an affidavit alone as enough “proof” for them. I have made claims on my tax return regarding my “other work related expenses, now the ATO have requested me to provide “supporting documents” to support my claim. I’m thinking that the receipt for use of “legal fiction name” is a form of proof / evidence “used to work out my claim” vs supplying nothing at all and may be harder for them to deny or reject.

This is my only battle currently and my main focus, I went for 100% of MY property and am ready to immerse myself into the full experience of retrieving my private property from the sly criminals.

-

Hey Juls, it’s good to hear of your success in retrieving all of your hard worked for money back. I am currently in the middle of completing my individual return, I am a little bit stuck. I am up to calculating my “other work expenses” to try to bring the taxable income down to under $18,200 as Mark has previously spoken of but recently in the updated tax video has mentioned to add in that figure at around $100. What method did you use? Also, tax department have withheld around $25k and it doesn’t seem right to submit that my total deductions add up to more than what I actually took home after tax?