Trust Circular #13 (a): Engage a Trust To Minimize Company Tax on Profits

Hi Folks

Mark Pytellek here again, of Private Trust Makers (PTM), the makers of your Trust.

Here’s the next chapter of the Non Registered Trust story on how you can engage your Trust to favor your financial future.

To all our valued Trust clients, including the most recent new ones, welcome to our monthly free educational circular as part of our program to educate and upskill our Trust clients so they learn to competently use their Trust without having to run to and rely on lawyers or accountants, thus saving you time and money. The earlier Trust Newsletters are available, free, on our website www.solutionsempowerment.org within the “Non Registered Trust” section under the tab “Resources”

Today’s subject matter topic is “Engage a Trust To Minimize Company Tax on Profits”.

Notice 1 the information delivered below is not legal ad-vice.

Notice 2 I am not a practicing lawyer nor a Certified Accountant.

Notice 3 the information delivered below is strictly private and confidential, delivered for your personal benefit

Engage a Trust To Minimize Company Tax on Profits

Worldwide folks who are in business are searching for ways to either minimize or eliminate company tax. It’s a subject matter worthy of a book in itself.

There are many legitimate ways to minimize and even eliminate company tax.

We list a few non-exhaustive options below.

- Cashflow (Otherwise known as “Income” in the public realm) splitting so as to minimize tax and protect cashflow from being taxed

- Under an oral or written agreement or contract, a Trust may be engaged by the company as an agent, sub agent, contractor, subcontractor, partner, consultant or other to:

- Conduct transactions with it – purchase from, sell to,

- Invoice for services rendered, consultancies conducted or goods purchased,

- Hire services, goods, labour, from or out to, the company so as to issue invoices that are utilized for tax deduction purposes

- To gift money, services, goods, assets, property or other to for either or both of, tax purposes and/or asset protection

Example “1” :Cashflow Splitting”

Caveat

If the company’s source of “income” or “cashflow” is derived from one payer-source, a government corporation, department or agency, or another corporation and they only conduct business with a registered entity then this method is not available for this example.

The example works optimally where there are multiple payers to the company, either several corporations, or numerous individuals.

Eg 1

A contracting business/company supplying goods or services to corporate clients, industry where some clients have no requirement for supply of an ABN whereas others require the trading entity to supply an ABN.

In this particular example;

Where services and/or goods are supplied by the company, it being the entity that does all the advertising and marketing (being public realm transactions), it can issue tax invoices with it’s Bank co-ordinates to the purchasing entity where the purchasing entity requires supply of an ABN by the supplier (the company).

Whereas where services and/or goods are supplied by the company to the purchasing entity, that entity not requiring the supply of an ABN by the supplier – company, the Trust can issue an invoice with it’s Bank co-ordinates to that purchasing entity.

You decide what percentage of the total cashflow derived from sales of services or goods is apportioned to the Bank account of the company and what is directed to the bank account of the Trust.

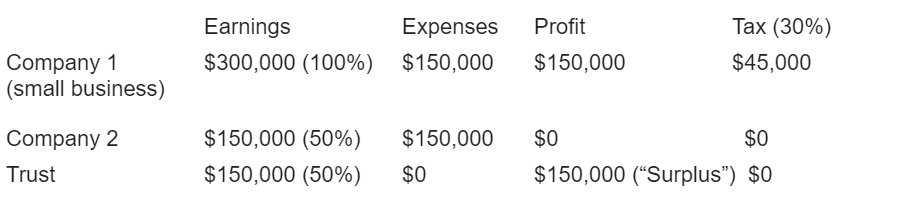

This way, the cashflow is split between two (or even more) entities so it appears the company turnover has dipped (sharply?), a common feature during recent times where quite commonly many businesses and companies are struggling financially.

The ice-cream on the cake is;

- Not only does it appear the company/business turnover is dramatically down, implying a much lower tax to be paid on a diminished profit, but

- 100% of the cost of production or the provision of services, is directed entirely against the business/company so it appears the business/company’s cashflow has been entirely mopped up by its costs of production thereby eliminating or greatly diminishing profit and hence tax obligations.

The remaining cashflow paid by purchasers of your goods and services is directed to the private realm of the Trust’s Bank account, which requires no audits, tax returns or tax payments! Your cashflow into the Trust Bank account, reflected as “productivity of labour”, is not taxable and hence preserved.

Eg 2

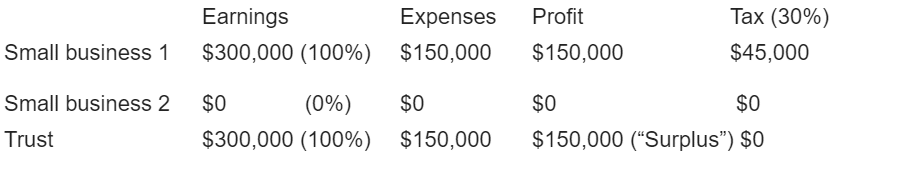

In instances where an individual or a small business derives all its cashflow from individuals within the general public, such no client requests an ABN on their transaction, you may elect to employ the process in Eg 1 or you may employ the following:

Your business registration may continue as a shell only, particularly where the business name is well known and has good will, but the total or overwhelming majority of the cashflow is directed to the Trust Bank account.

The key criteria determining whether 100% of cashflow can be directed to the Trust Bank account is if your business operates without advertising and marketing, these being activities in the public realm.

If your business operates by referral and word of mouth, and/or “walk by”, “drive by” traffic, you may operate totally privately through a Non Registered Trust (NRT).

A NRT is outside the public realm and is not subject to legislation, nor liabilities and obligations of the public realm, such as audits, tax, annual dispersal of income etc.

You can preserve all of what you produce. The pirates get zero!

Great business examples include: Drs, Dentists, Health Food Store/businesses, distributors, agents, subagents, consultants, small business, partnerships and much more.

We hope this information was useful and beneficial to you.

Next month we’ll look at the 2nd example – operating under a contract or agreement between a business/company and a Trust.

Look for the next Trust circular for further insights into practical and exciting applications of the use of your Trust.

Kind Regards,

Mark Pytellek

Principal

Private Trust Makers

in conjunction with

Solutions Empowermentment

Responses