Homepage › Private Community Forums › Discharging Liabilities (Debt) › Offer and Acceptence- 72 hours

-

Offer and Acceptence- 72 hours

Posted by Brandon-Nicholas on September 21, 2023 at 6:08 pm<div>Hey guys,</div><div>

Mark often talks about the 72 hour rule in regards to offer and acceptance.

E.g T bank kept your promissory not and did not return it within 72 hours there for they have accepted it.

Is anyone able to tell me where thid comes from? Is it from a specific act?

I am just trying to innerstand this better before I use it in court. Cheers!

</div>

rtw711 replied 1 year, 5 months ago 3 Members · 25 Replies -

25 Replies

-

Have you watched these webinars and bought these modules? There are scripts in the court role play module. https://solutionsempowerment.org/webinar-deliver-payment-by-way-of-promissory-note-to-discharge-a-debt/….https://solutionsempowerment.org/p/module-8-deliver-payment-by-way-of-promissory-note-to-discharge-a-debt/…https://solutionsempowerment.org/webinar-court-role-play-how-to-competently-address-court-win-your-case-and-or-have-the-case-set-aside-sine-die-or-dismissed/….https://solutionsempowerment.org/p/module-17-court-role-play-how-to-competently-address-court-win-your-case-and-or-have-the-case-set-aside-sine-die-or-dismissed/

solutionsempowerment.org

Page not found – SolutionsEmpowerment.org

Page not found – SolutionsEmpowerment.org

-

<div>Hi Morag-Janet,</div><div>

Yes I have watched some of these and read the transcript in your comment. However none of them answer my question about where thid 72 hour rule comes from?

I’m not at all doubting it’s legitimacy. However I am just trying to find out It’s origin so that I can confidently use it in court and in other instances.

I was dues to attend the last Q&A webinal and ask Mark myself but I couldn’t make it due to unforseen circumstances.

</div>

-

Here’s some interesting reading also………..https://www.scribd.com/document/75376683/Cancel-a-Citation-Within-72-Hrs

-

-

-

it’s one of the tenets of Contract Law. The 72-hour contract law allows consumers the right to cancel a contract during what is referred to as a “cooling off” period.

The timeframe for canceling is usually 72 hours, which means a consumer

has until midnight after the third day the contract is signed. https://www.linkedin.com/pulse/what-implications-72-hour-clause-have-you-consulted-nolte-joubert……………..2. Should the Seller during this time receive an acceptable offer the

Seller shall have the right to call upon the Purchaser by notice in

writing, to waive all suspensive conditions to which this offer is

subject within 72 (seventy-two) hours (which shall exclude Saturdays,

Sundays and Public Holidays). If the Purchaser fails to waive the

suspensive conditions within 72 (seventy-two) hours the Seller shall be

entitled (but not be obliged) to accept the second acceptable offer,

upon which this offer shall cease to be of any further force and effect

and shall accordingly be void ab initio.” -

I have a few questions about the 72-hour contract law.

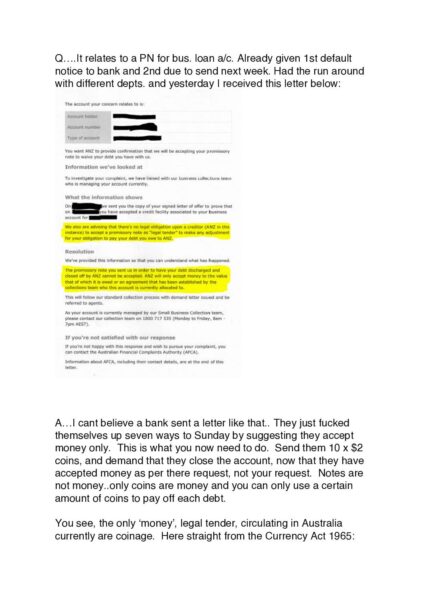

I sent 2 promissory notes to discharge 2 loan liabilities and they were rejected by the Loan Manager Company A (who manages loans on behalf of Lender Company B) with their interloping lawyer notifying me in a letter sent on their behalf to my email address. This email was sent to me and received on day 3, approx. 60 hours after confirmed Aust. Post delivery of promissory notes on day 1. My promissory notes and other original material were returned to me on day 5, approx. 102 hrs after original confirmed delivery on day 1. The lawyer wrote:

1. “We manage the loan on behalf of the Lender, Company B”

and “instructions on processing that payment pursuant to the Financial Emergencies Act”.

2. “We note that your correspondence and its inclusions appears to refer to legislation that is not applicable within Australia and that contains legal terminology that is often purported to be a method by which you may be able to cease making loan repayments.”

3. “We advise that, unfortunately, we are unable to accept this as payment towards your loan accounts.”

4. “You may consider this letter as our “Notice of Dishonour” as referred to in your correspondence.”

5. “We would accept cash payment by electronic funds transfer only”.

6. “We return the original material to you by express post”.

Note, I subsequently went ahead and paid off my 2 loans using my own funds and also didn’t follow through with the coffee shop meeting for presentment of the promissory notes since they were returned to me with the lawyer acknowledging their dishonour.

I intend to send a Notice of Demand for Payment of Debt (from Module 14 Exerting Pressure Points to Settle Any Matter) but want to clarify a few issues first.

Questions:

1. Given lawyer emailed me at approx. 12 hours prior to the 72 hour contract period expiring, but me receiving the promissory note and original material back after 102 hours had expired (i.e. on day 5), is my understanding correct that the loan company and all parties named in the Default and Liability Clause & Notice defaulted under the 72-hour contract rule? i.e. they had to return my loan material before 72 hours had expired even if the company is located interstate?

I also have Aust. Post tracking evidence that my original loan material returned via express post most likely was posted/mailed back to me after 72 hours had expired but cannot confirm this without questioning the lawyer. The Loan Manager Company A is located interstate and Aust. Post scanned the express post item at the airport on the evening of day 4, 15.5 hours after the 72 hour period had expired.

2. Under the Default and Liability Clause & Notices of the contracts created from the loan Statement of Accounts, did Loan Manager Company A’s non acceptance of my Promissory Note discharge the liability against me and create a liability against all parties named in the Default and LC & Notice, jointly and severally, of the amount stated on the Default and LC & N to me (hereafter ‘the Creditor’)?

My understanding is that it did. Is this correct?

3. If the total of the 2 promissory notes for the 2 outstanding loans was $200,000, then as there were 5 parties to the loan contracts (jointly & severally), would the total amount owing be:

A) 4 x $200,000 (Loans total owing) = $800,000 or;

B) 5 parties x 4 x $200,000 = $4 Million?

Can you also include interloping lawyer even if they weren’t originally included in the Default & Liability Clause & Notice of the contracts? The opening sentence in their letter was “We manage the loan on behalf of the Lender, Company B”.

4. What source(s) of information do you use for choosing the interest rate per annum charged on unpaid debts?

-

You might find some answers here about them sending it back.

-

-

You decide what interest rate you wish to charge, the same as they do.

-

If you were going to invoice each party separately then wouldn’t you send each invoice directly to each party?

-

Thanks M-J for that info.

However, there doesn’t appear to deal with the 72 hour issue.

Do you have Module 14 Exerting Pressure Points to Settle Any Matter where in the Notice of Demand for Payment of Debt, Mark deals with the interloping lawyer differently? Actually, I have discovered that in the 3rd notice, he holds the interloping lawyer liable for the debt owing as they are an agent for the debtor.

-

Yes I do have module 14. From my study it seems to me that whether they send it back within 72 hours or not is irrelevant from the point of view of the liability. If they send it back within 72 hours they have discharged your obligation as they are basically giving back what you have offered and a payment refused is a liability discharged, if they don’t send it back they have accepted that the liability has been discharged by the BOE. This is my understanding of how the process works.

-

Thanks for the clarification M-J. That is helpful.

However, with respect to my situation as explained, what is your understanding with respect to the Manager Loan Company A (and all other parties to the Contract) being in default under the terms of the Default and Liability Clauses of the Contracts? Are they still in default for breach of my endorsed contracts irrespective of when the promissory notes were returned to me, or when I was notified by email by interloping lawyer, and therefore are still liable to pay the sum specified in the Contracts if they defaulted on those Contracts?

-

What do you mean by ‘my endorsed contracts’?

-

The endorsed contacts were those created from the original Statement of Account and endorsed by me as per ANZ loan example in Module 8 – using Promissory Notes to discharge a debt. These contracts were sent with the promissory notes and other PN documents.

-

This reply was modified 1 year, 5 months ago by

rtw711.

rtw711.

-

This reply was modified 1 year, 5 months ago by

-

They are in default if they did not accept the BOE contract as it complies with their Acts and statutes.

-

If you had a default and liability clause, then they are now owing you whatever was stipulated in that default and liability clause.

-

-

If you have sent them the final default notice and created an equitable estoppel agreement and have not honoured the agreement made, then they are in default and in breach of the agreement established.

-

‘they have not honoured the agreement’ I meant to say.

-

Thanks for clarifying this issue for me. I’ll have to PM you at another time. Need to finish another letter urgently.

-

I have not started the 3 Notice of demand for payment of debt process.

-

-

Just as a note; if you want any matter to be extra private then it’s best to deal with it in PMs, then any spies that may have joined SE will not be able to see your conversation.

-

-

-

Maxim; Reprobata pecunia liberat solventem. – Money refused liberates the debtor.

-

-