Foundational Knowledge (Course Group)

Public Course Group

Public Course Group

Active 22 hours ago

To join this group, please first commence the ”Foundational Knowledge” course, which includes access... View more

Public Course Group

Group Description

To join this group, please first commence the “Foundational Knowledge” course, which includes access to this group.

Reclaim Income Tax

-

Reclaim Income Tax

Posted by gaz73 on June 8, 2023 at 11:47 amHi all,

Just want to know has anyone had success in reclaiming all or part of their personal tax that has been paid to the ATO. I still have all my all my Income Tax Accounts/ Statement of Accounts and assessment’s going back to 1996 up to 2013 when I stop work to look after my wife. As I understand paying personal is voluntary. I was a sole trader, then a partner ship with wife and force by the company I was working for as Subbie to become a company till 2013. Any info on this topic very much appreciated.

gaz73.

saul-james replied 11 months, 1 week ago 16 Members · 41 Replies -

41 Replies

-

I sent an affidavit of expenses and my source document, and received a full credit for individual tax for the last 3 years. However, they only sent refund cheques for half and stole the rest via “Integrated Client Transfer” to an alleged partnership debt without consent. Chris Jordan has been sent a Final Default notice and I haven’t heard back. I’ve also asked how is it fair and equitable for them to supply and accept tax returns back to 1984, yet they reject amendments beyond 3 years? It gets messy when we’re tied to business or partnership. Our partnership debt was discharged with a money order. I have not finished, by a long way. We need to separate ourselves from the business first. We haven’t had a letter for 2 months after the final default where we also requested evidence of their judicial authority to impose fines and penalties.

-

Hi, I am new to this, so please be gentle. What was in the affidavit? Cheers.

-

Hi. There’s a template in Module 2 for Minimising Tax. We state the facts that we are not born taxpayers, we are entitled to the productivity of our labour, etc.

-

-

-

I have been trying to source my source documentation since February this year. Had multiple phone calls, in the last conversation I was told they have tried to email me about the registration of birth certificate I have advised I have not received any emails, and too post any and all correspondence to me.

As soon as I get it I will amend my tax returns.

-

Out of curiosity, What is this source document you speak of?

Cheers

Zac

-

It’s the application form for a birth certificate our Mum or Dad completed as informant that confirms we were born alive, witnessed by the doctor and nurse.

-

So is it literally called the source document or is there another name for this document and could one obtain this through FOI or other methods?

-

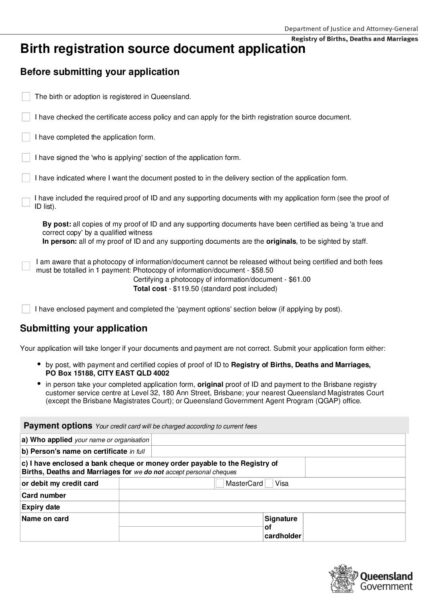

It’s called a “Birth registration source document application” in Queensland. Different states call it different names. Some call it an extract or full extract. Not easy to find.

-

-

Oh, I see. In Western Australia it would be the Birth Registration statement. Which I have already obtained.

-

When did you get yours pls as I’m trying to get mine now, they are saying I can have an uncertified copy but I told them I want the certified one. Did it take you long to get it and how hard was it please

-

-

-

-

-

-

-

Hi all , I’m not sure how to ask a question on here , I can only see an option to reply to others . So apologies , I am looking to do my tax myself, but I am late . According to some sources, if it is past October, I will have to get a tax agent to do it for me , is there some way ouround this if this is true ? Cheers twiggie

-

I wouldn’t think so, we are free to complete our own records at any time. If you are made that offer by anyone including the tax department, maybe you could reply “Thanks for your kind offer however I respectfully decline as I am capable of completing the return myself. By the way this is unsolicited contact and if you make any more unsolicited approaches and I need to take time to answer your correspondence there is a charge for my time, please find the attached fee schedule. If you contact me again it will be taken that you agree to these fees and you will be sent an invoice for $1,000” (or however much you specify on your fee schedule)

-

-

-

-

HI Gaz

Tax Amendment forms

- My 22 year old son

was able to get back his 3K PAYG TAX from 2020 using the tax amended form

on SE module.

a) When he recently did his 2021 PAYG Tax , claiming “other work related expenses” to take the taxable income to below 18K, the ATO did not accept this and were threatening a penalty/fine. (I’m not worried about the fine actually – I’ll just do a BOE) So I believe we have 30Days to respond to them if we want to object.- we are considering our options here, as this does take energy.

- My 20 year old

daughter did her 2022 PAYG Tax and claimed “Other work related expenses”

to bring her “income” down to below 18K and she got back all her 8K Tax.

She was overjoyed when she saw the text message come through on her phone

that the ATO had just deposited 8K into her account. She now says

“So Marks stuff does actually work” - I did a Tax

Ammendent for myself in Oct 2022 for a 2020 Tax return that was still

within the 2 year period. I heard nothing from them and so I called

them up 3 months ago and asked them about the progress and they said it had

been rejected. They had not sent me any written notification and

were not planning on sending anything either. The ATO consultant

said that I can submit an official objection for them to relook at the

matter again. I will do this, and if there is no success I am

going to consider the process of taking the matter to court. However

this will take a lot more energy. But for 16K, it may be worth

it. Not sure, we’ll see. A lot of battles to fight at present.

- I’ve just sent out

my 2021 Tax Amendment 1 month ago and still waiting on the outcome.

4. A friend of mine received a 6K refund using the same process, while her husband did not get any refund back – they asked for evidence of expenses and he didn’t follow it up (If the ATO did accept , he would have been entitled to around 12K in return)

5. My unqualified advice and gut feeling would be to try and keep your refund down below 10K,….you may have better success,…just my thoughts.

-

That’s good advice. They’re probably on the look out for non compliance.

-

Hi ct, thanks for the info you sent. Its mind boggling and where do you start.

I have to do a bit research into this.cheers.

-

Good idea. You could even lower it slightly above the threshold so there is only a minimal amount being taxed? That way they are happy they are still getting a small %

-

Hi fellow member, have you had success using the Bill of Exchange process? If so can you please provide some info of what worked for you? I would be so grateful.

- My 22 year old son

-

I was born in New Guinea. How do I obtain my Live Birth document. I tried to contact the hospital but they won’t respond. Do I go through the New Guinea Australian Embassy?

-

Hi Jessana there is another member who was born there maybe you could PM here and she might be able to help? https://solutionsempowerment.org/private-community/members/kangen-soutb/

solutionsempowerment.org

kangen-south – SolutionsEmpowerment.org

kangen-south – SolutionsEmpowerment.org

-

-

The embassy would be one place to start looking. Contact NHIS at

Perhaps try snail mail, or an FOI request.

If no records can be found, a wet ink signature letter with their official stamp to confirm they couldn’t find any records may suffice. Then find 2 living witnesses to attest that you are an alive, living breathing being. Good luck. You may be battling PNG time too…

-

Hello, I was born in Poland 40 years ago. I have no idea if the hospital I was born in would even have the original documents or how it was done back then. Would you have any suggestions on how to go about this? 🙏

-

Hi there is a lot of information in this document that might not help you get your source document but the very first piece of information on it should help you with an acceptable alternative

-

-

-

-

Fascinating thread, i have just joined and starting fundamentals training. I have a large tax debt and would like to learn how i can reduce that debt given paying tax is voluntary.

-

Hi Mioglio welcome. It is a steep learning curve and there are alternatives. To become competent in whatever you decide is the best path for you, you need to watch webinars and buy the modules associated with the webinar once you have got your head around the information in the webinar. Also you need to know how to competently hold your position with whatever method you choose so it is important to watch the webinar on holding ones position. If you want to discharge the debt then I suggest you start with challenging smaller matters first eg parking tickets. In this way you will be dealing with something that it won’t matter if at first you don’t get it over the line. Once you can competently deal with small matters then move on to something a little more challenging. In this way you will slowly learn and learn well. It can be likened to your first experience of learning how to walk as a toddler, a bit of trial and error at first. You could start by watching the webinar on how to deal with fines and how to protect your license here (this is one of the first things I did four years ago to enable me to learn how to deal with ‘authority’) … https://solutionsempowerment.org/p/module-36-deal-with-an-infringement-fine-penalty-from-a-state-debt-recovery-office-protect-your-license-from-fines-reinstate-your-license/

solutionsempowerment.org

Module 36 – Deal with an infringement/fine/penalty from a state debt recovery office, protect your license from fines, reinstate your license – SolutionsEmpowerment.org

-

-

Some amazing testimonies in the above thread, exciting times indeed.

I was reviewing the two affidavit documents in the Tax module download pack and at Item 6 the word ‘Seem’ appears, is this a spelling mistake or a correct legal word? Should it be ‘Seen’?

Thank you

-

-

Thank you Saul-james

-

-

-

Also on the bottom of the estopal Notice in the tax download pack there is this section at the bottom of the notice as follows, is this for us to fill in before sending?

-

I’m unsure which document you are referring to. What is the Doc number?

-

-

Form 3 Notice & Demand

-

No, that is for the government agent. You’re asking them for that information.

-

-

-

-

On the top of the court affidavit there is a reference UCPR35, does this apply to all States or should this reference be changed for the Qld court system?

-

Universal Civil Procedure Rules 35.1 refers to NSW as far as I can tell. So, yes, you would need it to align with whatever State you are in.

UCPR 35.1 – An affidavit may, with the leave of the court, be used despite any

irregularity in form.

-